How Does Lendtable’s ESPP Service Work?

Around 98% of companies in the US offer some kind of match on 401(k) plans and anywhere from 40% to 50% of the largest 3,000 companies in the US offer an ESPP. For many employees, these types of equity benefits have become an important part of their compensation packages. Lendtable is a relatively new company that can help people take fuller advantage of their 401(k)s and Employee Stock Purchase Plan (ESPP) benefits.

Given that we primarily focus on equity compensation, the purpose of this article is to offer an in-depth review of Lendtable’s ESPP Service and help you determine if their services would be a good fit for your situation.

ESPP Basics

Employee Stock Purchase Plans (ESPPs) provide participants with an opportunity to set aside money from each paycheck to eventually buy company stock at a discounted price.

Both the discount and the amount of money you’re allowed to set aside within the ESPP will vary depending on the company you work for. Most ESPPs cap their discount at 15% and usually companies won’t let employees put in more than 30% of their salaries.

ESPPs can be a bit tricky to understand, so we recommend reading two of our previous articles that provide more-detailed explanation of ESPP Basics and offer guidance to help you determine how much you should be contributing to your ESPP. We suggest opening both articles in another tab so you can read them later.

The basic gist is that usually ESPPs are worth maxing out. The discount you receive on shares is essentially free money if you’re able to sell your shares right after purchasing them. We’ll provide some examples below.

Basics of How Lendtable’s ESPP Service Works

Since so many companies offer discounts of 15% through their ESPPs, Lendtable’s goal is to help individual employees contribute the maximum to their company’s ESPP and take full advantage of the discount given.

For example, let’s say you work at Adobe and make $50k. Adobe’s max contribution is 25% of your salary and the discount on company stock is 15%. You know that Adobe’s ESPP has historically been a solid stock performer and you’d really like to max out your contribution, but you’re not sure how to manage parting with 25% of your salary to do that.

This is where Lendtable might be a good fit.

If you’re approved on their platform, Lendtable will advance you the money you’d like to contribute to your ESPP. So if previously you were not contributing the maximum amount, you could now increase your contribution percentage to the maximum contribution allowed. Lendtable would then directly deposit money into your bank account to make up for the money that you wouldn’t be receiving in your usual paychecks. This allows you to take full advantage of your company’s ESPP discount while maintaining the paycheck you’re used to receiving.

Lendtable’s ESPP Service Cost and Fees

Just like with any lender, you can expect to pay some fees to Lendtable. For Lendtable’s ESPP Service, they charge two different fees:

A $10 monthly platform fee for as long as you use their services

A 35% profit-share fee based on the discount applied to the purchased shares (We’ll break this cost down further in a moment.)

The $10 monthly platform fee is pretty self-explanatory. With an ESPP it’s really easy to establish a clear timeline for how long you’ll want to use Lendtable’s services. For example, if you wanted to try Lendtable for a year, you could communicate that to them by saying, “Hey, after the ESPP purchase on this specific date, I’d like to take a pause.” Then after that purchase goes through, you can reap the gains from your ESPP, pay your dues, and be on your way with no more $10/month charges.

The monthly platform fee is an easy calculation, but the 35% profit-share is a little more complex and requires a bit more knowledge of how ESPPs can make you money.

Lendtable’s ESPP 35% Profit-Share Fee

The thought with this profit-share fee is that Lendtable is providing you a way to contribute to your ESPP in a way that you wouldn’t previously have been able to do, so naturally, they’re going to want their cut.

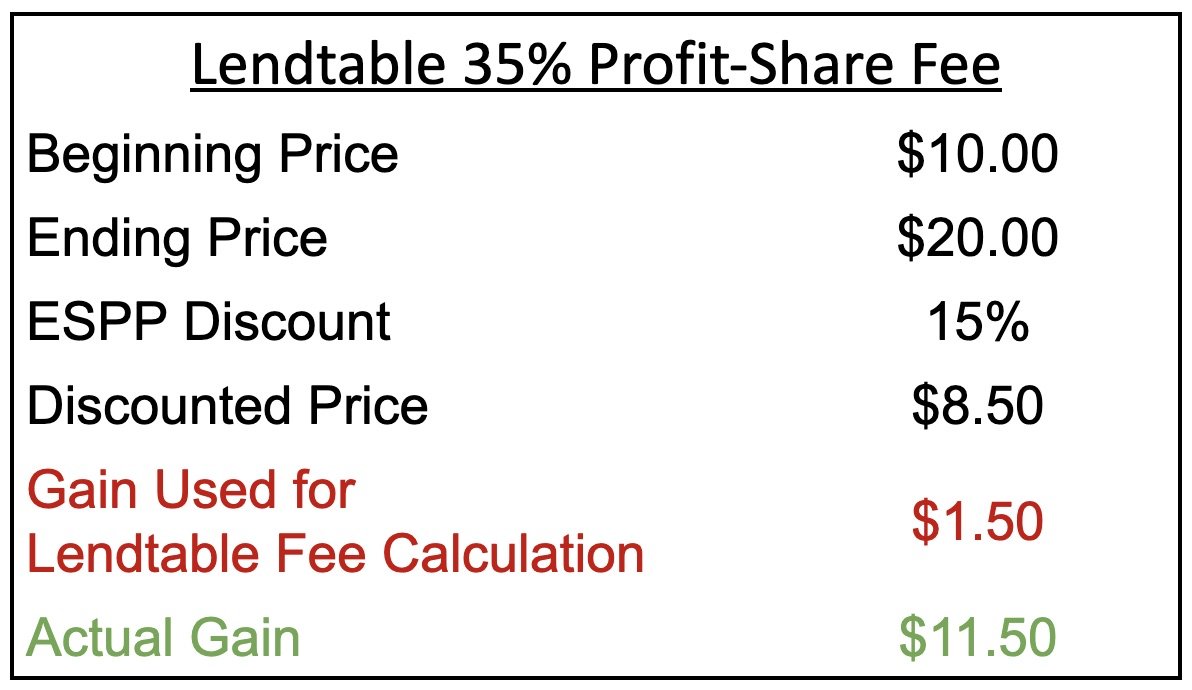

Lendtable charges their 35% ESPP profit-share fee based on the gain you receive from your ESPP discount, not necessarily the current market price of the stock.

Assuming your company offers a lookback, you’ll be able to apply a discount to the lesser of the price at the beginning of the offering period or the end. Whatever price is used to determine the discount within your ESPP will be the same price used to determine your gain or profit attributable to Lendtable.

For example, let’s say that your company offers a 15% discount and offers a lookback. Let’s also say that the company stock price starts at $10/share but rises to $20/share by the end of the offering period. You’d be able to purchase company shares for $8.50 each by discounting the $10/share, but really your shares are actually worth $20/share so you’ve received a discount greater than 15%.

This is the best case scenario for you because Lendtable only looks at the discount received and the price used to determine the discount to determine the profit-share fee.

As you can see from this example, for every share of this company that’s purchased, $1.50 will be attributable to Lendtable, even though your embedded gain will be much higher because the stock price has increased throughout the purchase period.

Lendtable then takes 35% of this $1.50 gain amount and adds it to the advance they’ve given you.

Lendtable’s profit-share fee of 35% for ESPPs may seem steep, and in some cases it is, but if you manage your ESPP properly, you should always come out ahead.

Let’s look at some examples assuming different stock price movements so you can get a an even better sense of how Lendtable’s ESPP service works.

Lendtable ESPP Example - Price Doesn’t Move

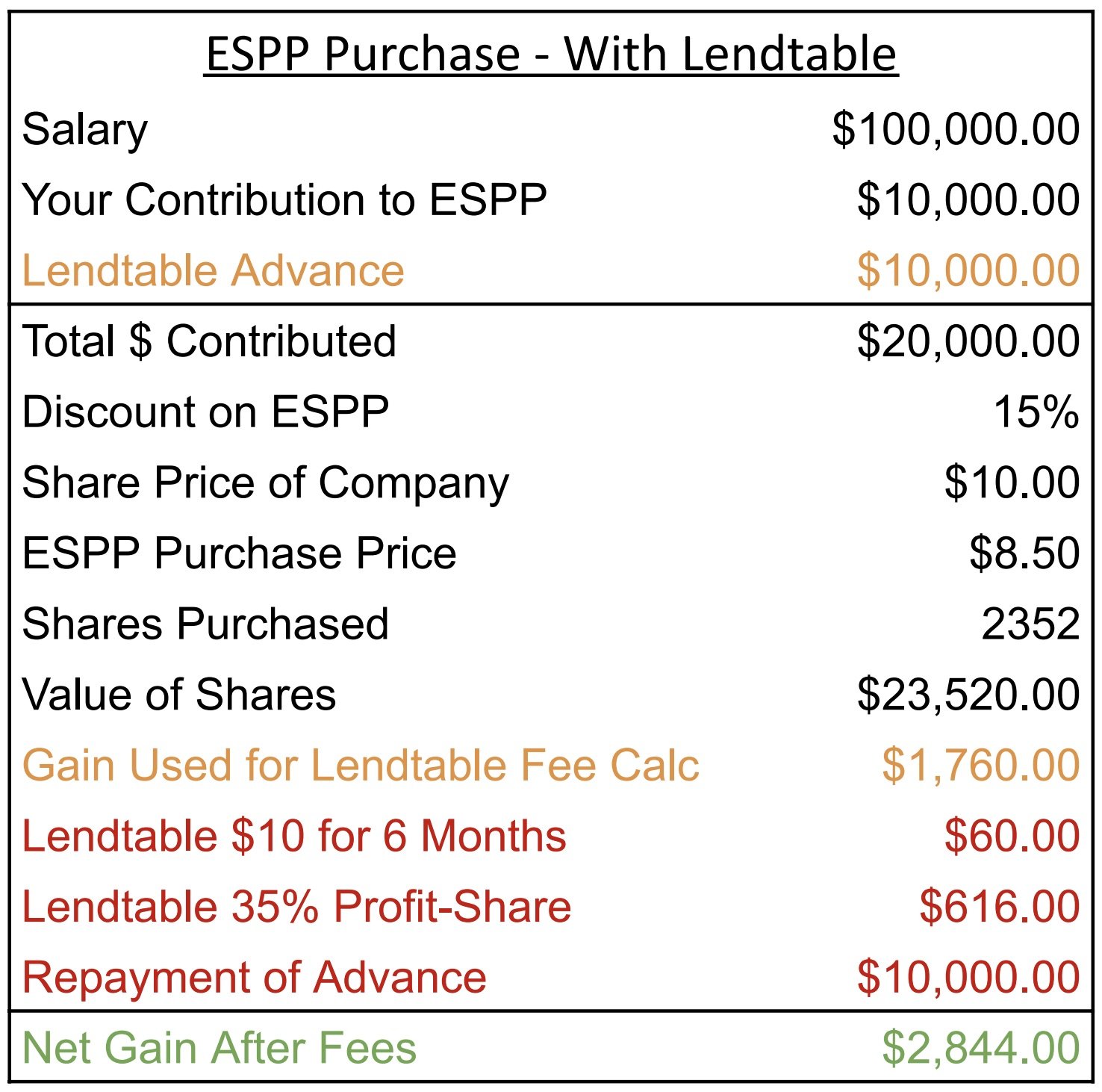

Let’s say that you earn a salary of $100k and contribute 10% of your salary to your ESPP. Your ESPP offers a 15% discount and the stock price stays at $10/share from the time your ESPP starts and ends.

Here’s what your pre-tax gain would look like from the ESPP if you don’t use Lendtable:

Now let’s say you want to contribute $20k to your ESPP so you decide to borrow $10k from Lendtable over the purchase period to do so. All $20k of the contributions will be made by you, but Lendtable replaces the $10k you would have normally received from your paycheck throughout the purchase period.

Here’s what your pre-tax gain would look like from the ESPP assuming Lendtable advances you $10k:

As you can see, even after paying the Lendtable fees, if using Lendtable’s services increases how much you can contribute to your ESPP, you’ll still be able to benefit without impacting your cash flow. In this example, you’d pay total fees of $676, and experience an extra $1,100 in gains after paying fees.

Lendtable ESPP Example - Price Goes Down

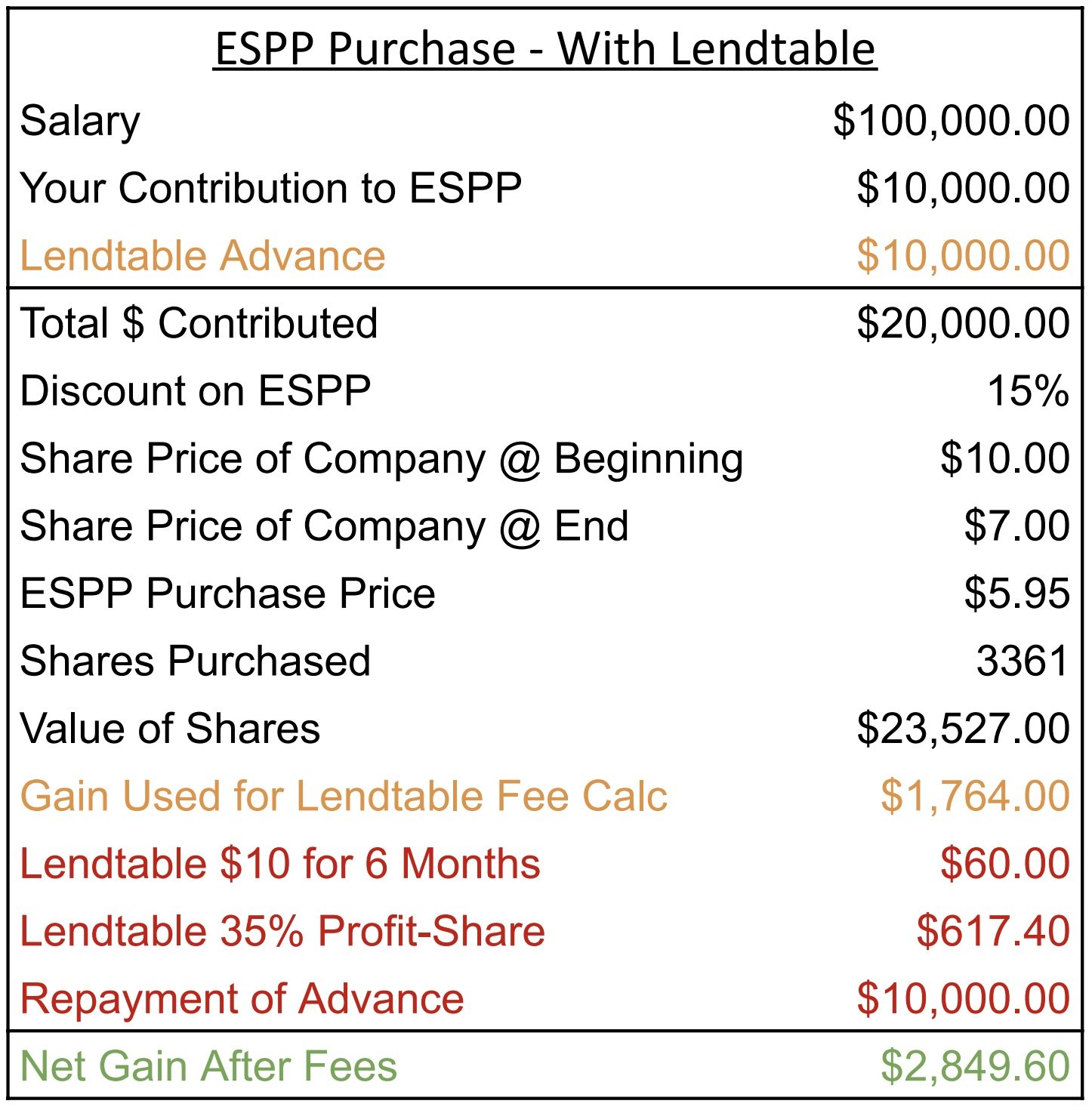

Assuming all of the same things about this particular ESPP, let’s assume that the stock price starts at $10/share and then goes down to $7/share by the end of the purchase period.

Here’s how you would fare if you didn’t use Lendtable:

As you can see, the lookback protects your investment in the ESPP and ensures a gain at the time of purchase. This is one of the reasons why so many people recommend selling ESPP shares immediately or shortly after purchase.

Here’s how you would have fared assuming you borrowed $10k to increase your contributions to your ESPP:

As you can see, this example is very similar to the first example where the price doesn’t change. This is due to the ESPP lookback.

Even if the price of an ESPP goes down, it is comforting to know that you’ll still be able to generate enough gain to pay back your balance and have leftover for yourself.

Lendtable ESPP Example - Price Goes Up

For our final example, we’re going to look at what happens when the company stock price increases during the ESPP purchase period. This is the most exciting scenario and illustrates why it’s worth maxing out your ESPP if you’re able to.

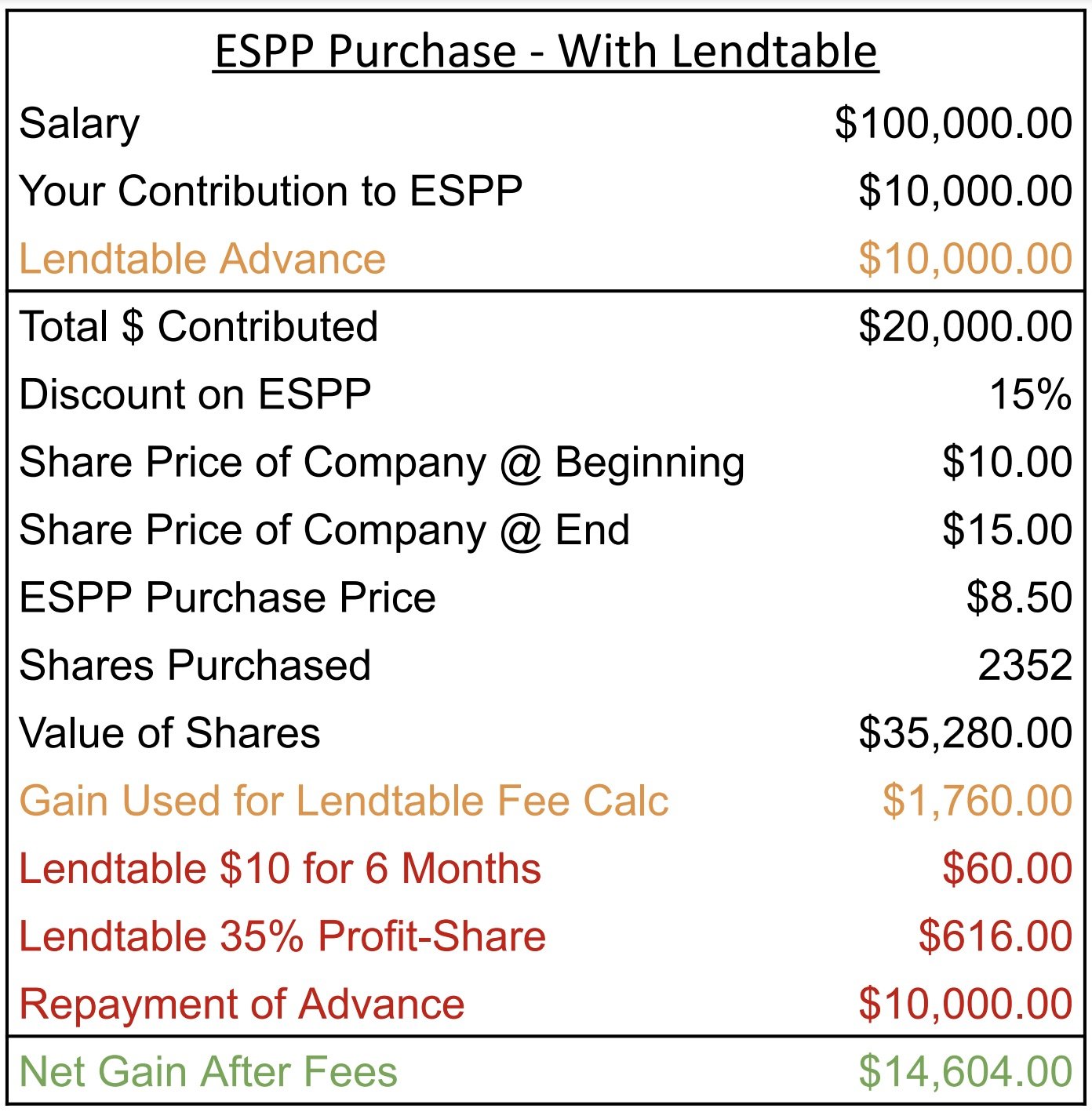

For this example, we’re going to assume all of the same things we assumed in the past two examples, only now the price starts at $10/share and rises to $15/share by the end of the purchase period.

In this example, participating in your ESPP led to a gain much larger than 15%. This is because you were able to purchase company shares at almost half the cost of what they are actually worth at the end of the purchase period.

As you can probably guess, adding more money to an ESPP in this scenario would increase the gain you’d experience.

Here’s what it would look like if you used Lendtable to help you increase contributions to your ESPP.

Because Lendtable’s 35% Profit-share is based on the price used to discount, you keep most of the profit-taking ability within the ESPP.

By using Lendtable in this example, you went from receiving $7,640 in gains, to receiving $14,604 in gains after fees. We’d argue that that $600+ in fees is well-worth the additional $7,000 in gains.

Additional Pros and Cons of Lendtable’s ESPP Service

Based on the examples we’ve provided, it’s pretty clear that the biggest pro of using Lendtable is that it allows you to take fuller advantage of your company’s equity benefits to realize greater financial gain. But there are other advantages to consider as well:

Lendtable’s ESPP service helps you maintain your usual cash flow and put money where you want it in the meantime.

At this time, there is no credit check, which means that there is no impact to your credit score.

It’s possible that you may be able to deduct some of the interest charged by Lendtable as investment interest. We are currently discussing this with a few CPAs for further guidance - you’re welcome to discuss with your tax professional as well.

There are a few cons worth mentioning:

You’ll want to be sure to sell your ESPP shares shortly/immediately after purchase to ensure that you can pay your balance owed to Lendtable. The last thing you’d want to do is wait and possibly see the value of your investments drop dramatically, impeding your ability to pay what you owe to Lendtable.

The Lendtable platform requires that you provide proof of income, employment, ESPP eligibility, and other personal/financial details. This is typical of any lender, but you can expect to spend at least 10-20 minutes gathering the necessary paperwork.

Lendtable is willing to work with most company ESPPs, but there are a few that are excluded.

This isn’t necessarily a con, but you’ll want to devote the study time necessary to really understand ESPPs. ESPPs are complicated enough on their own, but throw another factor into the mix and they become even more complicated. We highly recommend learning the basics of ESPPs, ESPP disqualifying dispositions, and ESPP qualifying dispositions.

What We Think About Lendtable

Overall, we think that Lendtable offers a valuable service to those who are a good fit.

If you’re not maxing out your contributions to your ESPP because you don’t want to sacrifice cash flow, then Lendtable is potentially a great fit.

If you’re able to max out your ESPP without much of an impact on your personal cash flow, then you probably don’t need to use Lendtable.

Because ESPPs offer such great financial benefit, it’s worth the additional effort and fees to take full advantage of your company’s ESPP.