ISO to NSO Conversion Explanation and Examples

In case you didn’t know, Incentive Stock Options (ISOs) can convert to Non-Qualified Stock Options (NSOs) under certain conditions. You’ll want to be aware of the primary ways these conversions happen because it will impact the way you manage your equity and plan for the future.

We’ve worked with people who have had their ultra-valuable grants of ISOs convert to NSOs without realizing that this conversion had already taken place. This seemingly small event ended up costing them thousands of dollars in taxes that they might not have had to pay otherwise.

Although we’ve done a Comparison of ISOs to NSOs before, the purpose of this article is to further examine the primary reasons ISOs convert to NSOs so you’re better equipped to manage your equity.

4 Primary Causes of ISOs Converting to NSOs

There are four primary causes of ISOs converting to NSOs and these will be the focus of this article. Technically, there are a couple more but our discussion of these four will cover 90% of cases and save you the unnecessary boredom.

Cause of ISO to NSO Conversion #1 - Quitting and Waiting 90+ Days to Exercise

Because ISOs offer potential tax benefits, there are special rules that govern them. One of those rules is that if you’re no longer considered an employee of the company that granted you ISOs, you have up to 90 days/3 months to exercise your ISOs - otherwise they will convert to NSOs or expire.

This situation comes up if your company has a longer than usual post-termination exercise period (PTEP for short). Meaning that the company gives people who quit a long time to exercise before their options expire.

While having greater than 90 days is relatively uncommon, it’s becoming more and more popular. Companies like Coinbase, Carta, Pinterest, and Expensify all offer longer than 90-day post-termination exercise periods.

To show a hypothetical, here’s what a 180-day post-termination window would mean for your ISOs and how they might convert to NSOs:

As you can see in the graphic above, for the first 90 days, your ISOs stay ISOs. You have time to exercise your ISOs and leave the company behind. But after that, they’ll convert to NSOs and the tax consequences will be much different.

Please note that if your company only offers 30 days to exercise post-termination, you’ll be limited to 30 days.

Cause of ISO to NSO Conversion #2 - Employer Changing the Original Terms of Your ISO Grant

Probably the most common cause of ISOs converting to NSOs is employers changing the terms of an ISO grant.

If an employer decides to either (1) extend your post-termination exercise window or (2) decides to push back the expiration date, your ISO will likely immediately convert to an NSO after the decision is approved.

This is important to be aware of because with layoffs or a company that just hasn’t met IPO expectations, sometimes companies will think they’re doing employees a solid by offering them a longer time period to exercise - when it may actually be causing an unanticipated change to their employees’ equity.

Sometimes an extension of the post-termination window and/or the expiration date is hugely beneficial; however, because the taxes associated with NSOs are so much different than ISOs, you need to make sure that the taxes don’t create issues you’re not prepared for.

Some good news here is that if your employer causes your ISOs to convert to NSOs by accident, there’s time to fix it. If your employer inadvertently made changes that converted your ISOs to NSOs, you can reverse the changes. You just have to reverse the changes by the earlier of the date of exercise or the end of the calendar year in which the ISOs converted to NSOs. (If you want the regulation number it’s covered under Treas. Reg. § 1.424-1(e)(4)(viii) - Inadvertent ISO to NSO conversion)

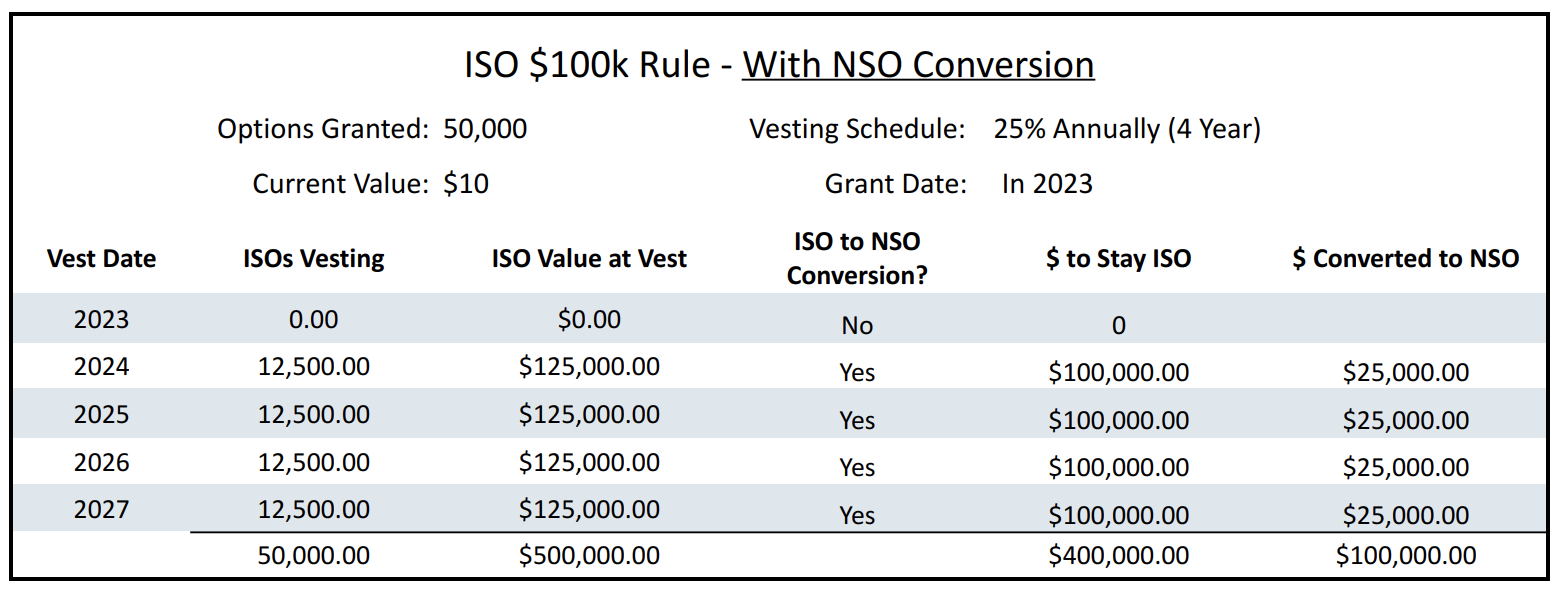

Cause of ISO to NSO Conversion #3 - You Went Over the $100k ISO Rule

Since ISOs have potentially better tax treatment, there’s a limit to how many ISOs you can receive.

ISOs are limited to $100k of exercisable value per year assessed on the value at the grant date, not some other time in the future. Let’s run through an example since that may not make much sense to you yet.

Let’s say you received a grant of 125k ISOs with an exercise price of $10 on 1/1/2023. This grant vests over 4 years. Here’s what that vesting schedule would look like:

As you can see, with 12.5k ISOs projected to vest every year for the next four years, there’s more than $100k of exercisable value during each year of the vesting schedule. Going over this $100k causes anything over to immediately be treated as NSOs.

Knowing the basics of this is critical because early startups might not be aware of this rule. If companies aren’t using Carta, Fidelity, or other equity management providers, it’s entirely possible to receive a grant of ISOs that includes a portion that has been converted to NSOs without you even realizing it.

Cause of ISO to NSO Conversion #4 - Switching to a Contractor Role and Waiting 90+ Days to Exercise

Just like what happens if you quit, if you become a contractor to the company you work for, the 90-day ISO to NSO conversion clock begins to tick.

ISOs can only be granted to employees of the company. Contractors aren’t technically considered employees so therefore can’t receive ISOs (they can however receive NSOs).

If you end up switching to a role where you’re no longer technically considered a W-2 employee, you’ll want to be sure you’re aware of any conversions that might be happening with your ISOs.

Example #1 of ISO to NSO Conversion

We’ve mentioned multiple times how different the tax scenarios can be, so let’s take a look at an example.

Let’s say you’re single, make $180k/year, and have been granted 25,000 ISOs with an exercise price of $.01. The company’s current value (FMV) is $1.

Here’s what exercising all 25,000 options would look like if they were ISOs as well as what it’d look like if they converted to NSOs:

Assuming a federal tax rate of 32%, the ISO to NSO conversion will cause immediate taxation at exercise of about $8k. Whereas if the options had stayed ISOs, you’d be able to avoid paying taxes until you ultimately sell your shares. (Which at this income level would be a tax rate of 15%.)

Paying ~$8k in immediate taxes may not seem that bad, so let’s look at another, not too far-fetched example of ISOs converting to NSOs.

Example #2 of ISO to NSO Conversion

Just like our previous example, let’s assume that you’re single, make $180k/year, and were granted 25,000 ISOs with an exercise price of $01. Only now let’s assume that the current/fair market value (FMV) is $10/share instead of $1/share.

Here’s what exercising all 25,00 options would look like if they were either ISOs or NSOs:

As you can see, both ISOs and NSOs cause some taxation at this level of bargain element/spread. ~$56k is due for ISOs and ~$86k is due for NSOs.

The calculation to determine AMT on ISO exercises is a little tricky, but it's important to be aware that paying AMT is like prepaying taxes, and oftentimes you’ll receive a credit back for what you pay upfront.

The calculation to determine the tax on NSO exercises is much simpler - it’s all treated as ordinary income and is taxed as such.

Because of the difference between AMT and ordinary income rates, NSOs typically result in more taxes paid if you experience a conversion and exercise immediately.

Final Thoughts on ISO to NSO Conversions

By now, you likely have a much better understanding of what might cause your ISOs to convert to NSOs. Though they have similarities, ISOs and NSOs are different types of equity and each requires different levels of planning.

The main reason you want to be aware of ISO to NSO conversions is so that you can account for, and properly plan for, any resulting tax liability. Because the taxation of ISOs and NSOs is so drastically different, you never want to allow yourself to get caught in a situation in which you think you’ve exercised ISOs, but in reality have exercised NSOs.

Knowing the primary reasons ISOs convert to NSOs empowers you to plan for the future more accurately. If you know exactly how long you’ll have to exercise ISOs before they convert to NSOs or expire, you place yourself in a good position to maximize the equity you’ve been granted.

Startups aren’t always familiar with some of these rules and often run afoul of them. If they accidentally mess things up for you, there’s a chance they’ve messed things up elsewhere. Pointing out a mistake early on will win you kudos not just with the company but also with other employees in the same boat as you.

You’ll want to maintain an accurate assessment of your outstanding equity at all times. It’s impossible to truly understand the value of your equity if you don’t have an accurate assessment of what you actually own.

If you sacrifice ISOs for NSOs in exchange for a long exercise period, it could be beneficial as it gives you more time to wait and see how the company performs in the future.

We hope you’ve found this helpful. If you’re in a situation in which you think you might have had ISOs convert to NSOs and want some guidance, please reach out to team@equityftw.com. One of our services is to help you make decisions with what to do with your ISOs and/or NSOs.