RSU Taxes When Moving States

Determining the taxes on Restricted Stock Units is relatively easy if you stay in the same state, but what happens if you move to a different state? What is normally a pretty simple tax calculation may now become a source of anxiety and leave you wondering if you need to talk to a professional.

In this article, we’ll discuss how RSUs are taxed when you move to a different state, share examples of what happens when people move states with RSUs, and provide a framework to help you keep everything organized in preparation for tax time.

Taxation of RSUs When You Move

You’ll recall that RSUs are taxed at the time they vest and this still holds true even if you move states, except that it introduces an additional wrinkle of complexity to the situation.

If you move to a new state during your vesting period, you will owe taxes based on a ratio that considers two factors:

Total number of workdays from the grant date to the vest date

Total number of days worked in each state

Please note the emphasis on days worked and on workdays. Using total days worked gets you close, but the correct way to calculate is by using the total number of workdays. Running the calculations is cumbersome enough, you may as well try to make them as accurate as you can.

Let’s look at some examples and then we’ll describe the framework we use to help with calculating taxes.

Simple Example of RSU Taxes When Moving States

The most common scenario we see is people leaving California to try to avoid paying state income taxes. With a top tax income rate of 13.3% in 2025, it’s understandable that people will try to avoid paying taxes when they can. In fact, moving out of California is a tip we suggest in our How to Avoid Taxes on RSUs article.

The problem with moving is that California is still going to want their share even after you move, so leaving the state often doesn’t work out how people anticipate it will.

Let’s examine a simple example:

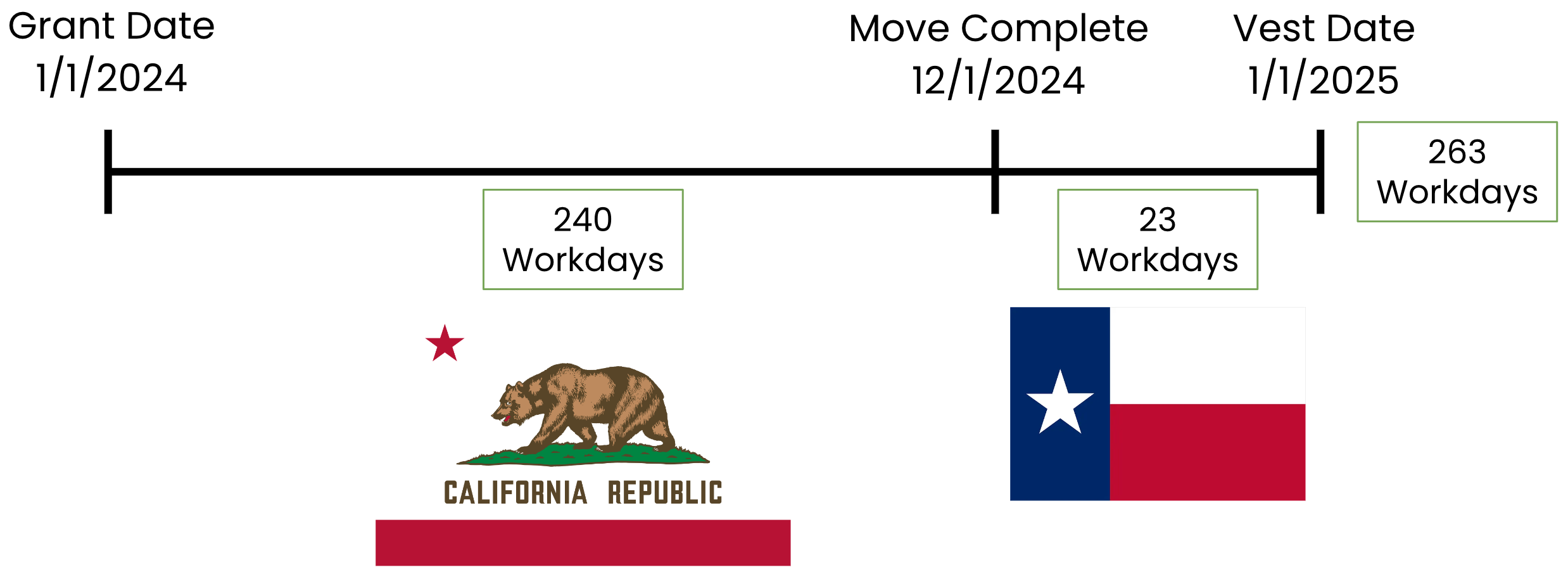

Let’s say you received a grant of 1,052 RSUs on 1/1/24 and the entire thing will vest on 1/1/25.

You’ve lived in CA your whole life, but decide you want to enjoy some delicious BBQ and some even more delicious tax savings in the TX. So, you complete your move on 11/30/24 and continue working as normal on 12/1/24 until your RSUs vest on 1/1/25.

Here’s what the timeline of events looks like:

Examining this timeline visually helps you understand the argument the State of CA makes when it goes after taxes from people who’ve left the State. If you lived in and worked in CA, earning the right to receive some income in the future, then it makes sense that you should pay taxes based on the time you worked in that State. (We’re not saying we like it, only that it kind of makes sense.)

Now that we have a clear picture of what the timeline in each state looks like, we need to calculate three numbers to help us build an allocation ratio for each state.

Total # of workdays between the grant date and the vest date

Total # of workdays worked in CA

Total # of workdays worked in TX

Here’s the timeline, now with those numbers included:

With this information, we can now determine the percentage of income/RSUs that needs to be allocated to each state for the 1,052 RSUs that vested on 1/1/25.

240/263 workdays were in CA (~91.25%)

23/263 workdays were in TX ( ~8.75%)

If we apply both of those percentages to the 1,052 RSUs, we’d have 960 RSUs subject to CA income taxes and 92 RSUs would be allocated to TX.

If you move to Texas thinking the move will allow you to avoid 100% of California’s income taxes and then get hit with 91.25% being applied to California for taxes, you’ll be pretty disappointed.

This same allocation principle applies to most states, but because so many CA employees receive RSUs, the State of California is vigilant in monitoring and enforcing this. We often see similar situations play out in NY where the state income tax is also high.

More Advanced Example of RSU Taxes When Moving States

We just tackled a fairly simple example, so let’s now take a look at a more advanced example with a more realistic vesting schedule.

In this example, we’re going to assume the same dates for the move to TX. We’ll also assume that you love it so much there that you decide to stay for the entirety of your remaining vesting schedule.

As far as the actual grant of RSUs goes, we’re going to assume that you receive 400 RSUs this time and that they’ll vest in 25% increments over 4 years.

Here’s what the timeline of events looks like now:

The difference in this scenario is that there are now four vest dates.

All four of these vest dates require their own allocation percentage to be applied to each batch of RSUs that will be vesting. Here’s what that looks like in spreadsheet format:

There’s a lot to look at, but here’s how the spreadsheet is organized:

The left set of columns shows the dates RSUs are vesting

The middle set of columns shows the total workdays in each state from grant to vest

The right set of columns shows the allocation percentage to each state at each vest date

As you can see, the longer you continue to live in TX, the more you’ll have RSUs attributed to TX instead of CA. It takes years, but eventually most of your RSUs will be attributed to TX since you’ve been there for the longest time.

Moving States with RSUs Framework

Now that you’ve seen some examples and understand how RSUs are taxed when you move, it’s time to provide our framework for organizing your data so you can correctly track everything.

#1 Gather details for your RSU grants

The first step is to gather all the relevant details for your grants. Your equity plan is probably managed by Morgan Stanley (Etrade), Shareworks, Schwab, Fidelity, or Carta. Most providers make it easy to gather the data you need, you’ll just want to make sure you’re getting enough detail to show all of the vest dates for all of your grants.

#2 Organize RSU grant details

We find organizing works best in Sheets or Excel. You’re welcome to copy our simple format in the screenshot from the advanced example.

#3 Map out residency timeline

In order to calculate where you owe state income taxes, you need to be clear on when and where you’ve lived through the course of your RSU grants. It’s important to be honest here and make sure that you’re able to substantiate any of the dates you’re using.

#4 Determine the allocation ratio for each vesting for each state

Just as we illustrated in the advanced example, you’ll need to determine the ratio of time spent in each state from the time you received your grant of RSUs to all of the times they vested.

#5 Apply ratio to either shares or RSU income on the vest date

In our example, we applied the allocation ratio to actual shares, but you will ultimately need to determine the dollar amount that became taxable on that date and then allocate the taxable dollars to different states based on your allocation ratio.

#6 Don’t commit tax fraud

Trying to trick tax authorities is a game you shouldn’t play. Even if it means paying more taxes, it’s the correct thing to do.

If you’ve moved states and have a significant amount of RSUs coming in, it’s usually worth running your situation by a reliable tax advisor. We have plenty of CPAs and EAs in our network who can assist you.

Remote Work in 2024

State taxing authorities and the IRS haven’t quite caught up to the fact that so many employees now work remotely for companies which are based specifically in one state.

If you work for a company that is based in CA but you actually live in NV or TX, it makes life easier if the company puts you through payroll as a resident of NV or TX (or wherever you actually live). Many companies default to leaving employees as CA employees even though they’re living and working remotely in another state.

This can be problematic because the tax forms your company submits will look a lot different than what you’re claiming on your tax return.

Our Thoughts on Moving States with RSUs

RSUs still serve to build wealth, even if moving to a different state may cause a little extra tax calculation headache. If you need help calculating/estimating your taxes after a move, we’re happy to help you figure it out and/or refer you to a tax professional who can help with the return.

Thanks as always for reading, please reach out to team@equityftw.com if you have questions.