Tips for Selling RSUs at a Loss

You were given a grant of Restricted Stock Units (RSUs), they vested, and with market ups and downs, your RSUs are showing a loss. It doesn’t feel great to sell things that have gone down in value, but sometimes it's unavoidable and with RSUs, sometimes it’s actually beneficial.

The purpose of this article is to provide you with 6 tips for selling RSUs at a loss.

Before diving in, you should take some comfort in the fact that people sell RSUs at a loss all the time. And after reading these 6 tips for selling RSUs at a loss, you’ll not only have a better understanding of what’s going to happen, you’ll be able to live with that decision a little more easily.

Tip #1 - Evaluate whether you need to sell RSUs at all.

One of the toughest things about receiving RSUs is knowing when to sell RSUs.

If you make between $100,000 and less than $1M, it’s unlikely that you’re setting aside enough money to cover the taxes as your RSUs vest. That’s why it usually makes sense to sell some RSUs at the time of vest to ensure that you at least have enough cash for taxes.

Outside of that, whether or not you choose to sell your RSUs depends a lot on what your finances look like and what your needs are. We’ve written previously about how much company stock is too much and provided a series of questions to help you figure out if you have too much. We’d recommend that you give it a quick read.

The basic gist is that if you have debt, no other investments, and/or owe taxes, it probably makes sense to sell RSUs, even if you’re selling them at a loss.

Tip #2 - Have a plan for the cash after selling RSUs.

If you are going to sell your RSUs at a loss, you’ll want to make sure that the cash is being put to good use afterward, that it is helping you meet important financial goals. Some of these include things such as:

Establishing or adding to an emergency fund

Setting aside money for taxes

Investing cash into more diversified investments like (VTSAX, SCHB, or ITOT)

Using cash for a down payment on a home

Selling RSUs at a loss just because they’re at a loss isn’t a comprehensive strategy. The dollars should serve an important purpose.

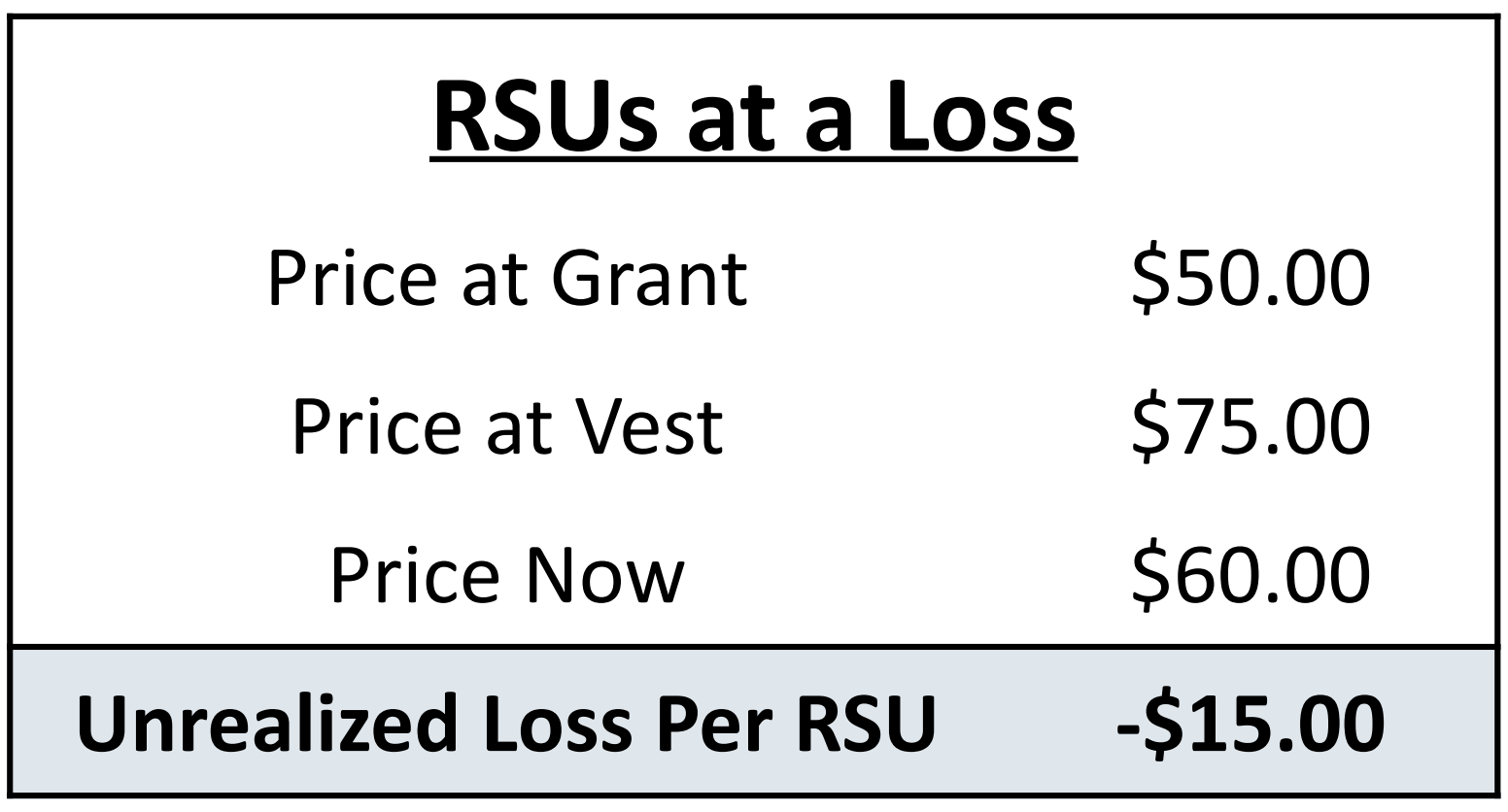

Tip #3 - Your loss is determined by the value on the vest date not the grant date.

The value of your RSUs at the time they were granted to you does not matter at all after they’ve vested.

The loss at which you sell in E-Trade, Fidelity, Schwab, etc. is based on the price your company stock was selling at on the vest date.

For example, if you were granted RSUs at $50 which rose to $75 at vest and are now trading at $60 a share, you owed taxes on the $75/share and now have a $15/share unrealized loss.

It’s really common for people to get attached to the highest share price a company has been at, when really what matters most is the price the company is at now and the total value of RSUs you hold.

Sure, it would have been nice to sell at a higher price, but if you have several hundred thousand in vested RSUs now, that’s still fantastic.

Tip #4 - Selling RSUs at a loss can provide a benefit.

When you sell RSUs at a loss, the good news is that there are no taxes caused by the sale. And more good news, there will actually be some positive tax implications!

When selling RSUs/stock at a loss, you’ll be officially locking in losses, which are called realized losses. These realized losses are tracked for tax purposes and will eventually end up providing you with a benefit.

Realized losses can benefit you in two ways:

They can offset capital gains.

If you have realized losses at the end of the year, you’ll be able to use up to $3,000 to offset your ordinary income (which is a great use).

Whatever you don’t end up using in that tax year rolls over to the next until you use up all the losses you’ve accumulated.

Let’s review an example to illustrate. Let’s say that you had 500 Amazon RSUs that vested at $175, and now the price is at $150. And let’s assume further that you’re single and earn $250k/year. Here’s what your total unrealized loss would look like:

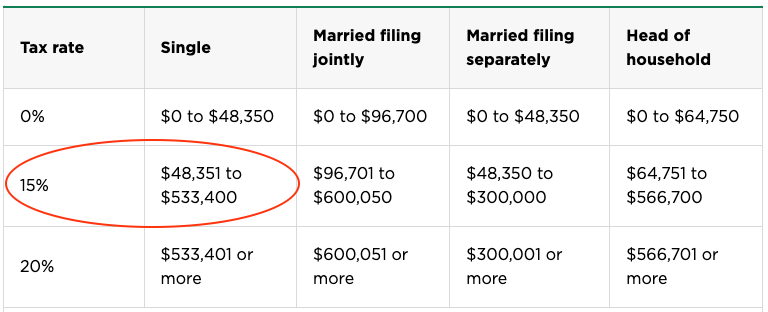

Assuming no deductions or reductions in income, here are the tax brackets you’d be in for ordinary income tax rates and long-term capital gains rates:

For ordinary income, you’d be in the 35% tax bracket and for long-term capital gains, you’d be in the 15% tax bracket.

If you sold all 500 Amazon RSUs at $150, you’d go from having $12,500 in unrealized losses to $12,500 in realized losses. And based off of what tax bracket you’re in, you’ll be able to use these losses towards offsetting long-term capital gains or ordinary income.

Long-term Capital Gains Offset

If you use these $12,500 of realized losses to offset against future long-term gains, you’d receive a tax benefit of 15% multiplied by the number of losses you’ve used to offset.

The total benefit would be $1,875 assuming you stay at about the same income level.

Ordinary Income Offset

If you end up not using any of these realized losses to offset gains this year, $3,000 will be used against your ordinary income, which will provide you a benefit of 35% multiplied by $3,000.

The initial benefit for this type of offset would be $1,050, but you’d still have $9,500 of losses on your books that you can use either to offset gains or to reduce ordinary income again.

Tip #5 - Consider selling RSUs that are at the greatest loss.

Because selling RSUs at a loss can provide you a benefit, it often makes sense to sell the specific RSUs that are at the largest losses so that you have more losses available to you to offset gains or your income.

Assuming you’re in a higher tax bracket, the benefits of using these losses to offset ordinary income can be quite large. If it weren’t for the $3,000 cap on deducting losses, it’d be talked about more frequently.

Still, if you have some RSUs that are at a greater loss, it often makes sense to sell the specific RSUs that have the largest losses. This results in more realized losses that you can use to either offset other gains or use against your ordinary income.

Tip #6 - Track what vests and ESPP purchases are coming up.

Another factor to consider when selling RSUs at a loss is if you’ve acquired any shares of the company in the last 30 days or will be acquiring shares in the next 30 days.

Any acquisition of shares counts. So whether it’s RSUs that vested, ESPP shares that were purchased, or even dividends that were reinvested, all of these count as an acquisition.

If you sell RSUs at a loss either 30 days before an acquisition of shares or sell RSUs at a loss 30 days after an acquisition of shares, you’re going to trigger what is called a Wash Sale.

Wash sales remove your ability to realize losses and instead add the loss you would have taken to the basis of the shares you purchased.

Wash sale rules and RSUs are complex, so we wrote the linked article to help teach you more. Please know that if you have either a full or partial wash sale, it’s not the end of the world. Advisors like to scare people into being afraid of wash sales, but sometimes they’re unavoidable.

By tracking all the transactions involving your company’s stock, it’ll make it possible for you to avoid or at least mostly avoid having to deal with wash sales.

Final Thoughts on Selling RSUs at a Loss

In an ideal world, all companies’ stocks would only go up, but that’s not what happens in real life. All we can do is make decisions based on what’s happening now and what we think will be best for us in the future.

If you want some help reviewing your specific situation and would like us to chime in on whether or not we think it’s worth it for you to sell your RSUs, we’re happy to share some thoughts. And if you need a bit more help, we’re always willing to refer you to a professional you can trust.

Thanks for reading!