7 Tax Strategy Mistakes People in Tech Make

Most financial decisions come with some sort of tax consequence whether you want it to or not. After working with hundreds of people in tech, we’ve noticed a few tax strategy mistakes that people make all the time.

The purpose of this article is to provide you with our non-exhaustive list of common tax strategy mistakes. We’ll both point out the strategy mistake as well as share how we like to think through things with our clients.

Mistake #1 - Holding RSUs for a Year is Not a Tax Strategy

We see people (all the time!) hold RSUs for a year and shoot for long-term capital gains treatment.

It’s important to remember that RSUs are fully taxable when they vest. The capital gains part comes after vest, and it is the movement of the stock price up or down after vest that will dictate whether you have a capital gain or loss.

The thing is, because RSUs are fully taxable at vest, it’s like you’re receiving an equivalent amount in cash and then investing immediately back into your company stock.

If you sell your RSUs at vest and immediately deploy that cash into another investment, this other investment will start the long-term capital gains clock in the same way your RSUs would have.

The decision to hold RSUs after vest isn’t a tax decision, it’s an investment decision.

Mistake #2 - RSU Underwithholdings Cause Tax Surprises

If you’re receiving RSUs and make over $200k, you likely don’t have enough being withheld from your RSUs when they vest.

This means that when tax time arrives, you’ll probably owe more money than you were expecting to owe.

Most of this issue boils down to what are known as Statutory Withholding Rates. (The rate at which companies are required to set aside taxes when RSUs vest.)

At the Federal level, RSUs are withheld at 22% if you’ve received less than $1M to date. Once you cross the $1M threshold, RSUs will start to withhold at 37%.

Above 22%, there are 24%, 32%, 34%, and 37% tax brackets that your money will be taxed at depending on your income level.

This can have far-reaching consequences and often results in tax penalties. We’ve written previously about how to avoid underpayment penalties in California. That article would be a good starting place to learn about estimated tax payments, regardless of where you live.

Mistake #3 - Not Maxing Out Pre-tax 401(k) Contributions

If you’re in the highest tax bracket and live in a high-income-tax state like California, there is a strong case for maxing out your pre-tax contributions to your 401(k) instead of putting money into the Roth 401(k).

High-earners often believe that because the earnings and growth within the Roth 401(k) is tax-free, that it’s worth paying the tax to get the money in there.

The problem with this is that it does not account for what your future tax rate might be in the future. And when we say future tax rate, we mean your effective tax rate or average tax rate.

Someday when you’re retired and you’re pulling from your investments to live, your income will work its way through all of the tax brackets, resulting in a lower tax bracket than you’d expect.

If you’re a very high-earning person working in tech, your tax bracket later in life will likely be lower than it is now. (Which is a little hard to accept sometimes.)

It’s also reasonably likely that rather than staying in California, New York, or another high-income tax state, you’ll choose to move to another state at some point. If this happens, all the tax-deferred money from a pre-tax 401(k) would avoid state income taxes in the previous states you lived in.

Mistake #4 - Not Using a Mega Backdoor Roth or Regular Backdoor Roth

The usage of the phrase “Backdoor Roth” seems sneaky, but it’s not, and many companies provide the option for employees to use what’s called a Mega Backdoor Roth within 401(k) plans.

If you have the option to use a Mega Backdoor Roth, it can be a huge boost to your future net worth if you’re able to maximize it.

The max you can put in varies based on how much money you receive from your employer in match money or other contributions, but even with modest additions of $20k per year, it can save you hundreds of thousands of dollars over the course of your life. Here’s a quick example:

The big drivers behind why Roth is beating a regular taxable account are (1) taxable accounts have some level of tax drag due to dividends and interest that are generated, and (2) as your investments appreciate, it means you’ll have to one day pay capital gains taxes on the appreciation.

Even if you can’t do the way cooler-sounding “Mega” version, everyone is able to do a standard Backdoor Roth.

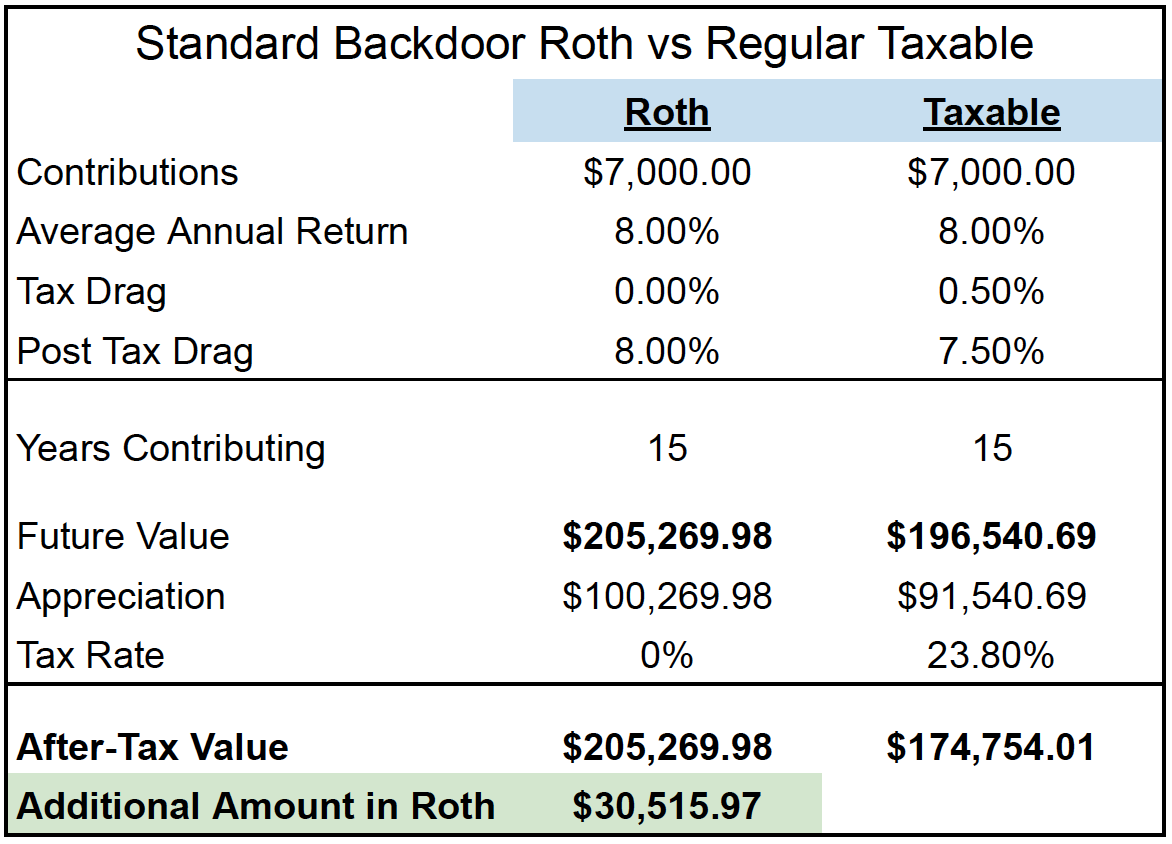

With smaller contribution limits of $7,000 for 2025, people often wonder if it’s worth the hassle.

Here’s a quick comparison of just doing $7k into your regular, non-mega backdoor Roth.

As you can see, even if you’re limited to $7k a year, it’s still extremely beneficial over the long run.

We also want to call out that we stopped the analysis at 15 years. If you were to stop contributing after 15 years and just let everything ride for another 15 years, the difference between the two would continue to widen.

If you have 15-30 minutes a year, it’s worth the hassle to complete your standard Backdoor Roth.

Mistake #5 - Not Paying for a Good CPA

Many people in tech love to DIY their taxes. It’s cheap, you don’t have to communicate with anyone else, and it can take an afternoon if you have all your data organized.

The problem is that as you earn more and your return becomes more complex, the cost of an error or the price of a missed strategy will cost you multiples of what you’d pay a CPA to do the work.

If you have any type of equity compensation, whether it be RSUs, ESPP shares, NSOs, or ISOs, there are mistakes that can easily happen when completing tax returns. (The RSU Double Tax and the ESPP Double Tax are both examples of this. Both of these probably deserve to be highlighted on their own!)

When we work with clients, we advise them on tax planning but also help them craft forward-looking tax strategies to help avoid taxes on RSUs and just avoid taxes in general. We also make sure that all of our clients have a qualified tax preparer so that their returns are done correctly.

Mistake #6 - Letting Cash Generate Fully Taxable Income

A perk of interest rates being high is that cash actually generates some income. The problem for high earners is that often they are not optimizing how they’re holding their cash.

We commonly see high earners in California leave their cash in high-yield savings accounts, or even worse, a regular savings account at a big bank like Wells Fargo or Bank of America.

You should absolutely be earning interest on your cash, and if you’re a high earner, we’d suggest that it’s probably best to find a method of earning interest that’s not fully taxable.

For example, US treasuries are not taxable at state income tax levels. So, if you purchase a treasury bond or a treasury money market fund yielding 4% and your tax rate in California is 13.3%, your after-tax yield would be 2.52% vs a 1.99% in a fully taxable fund.

Mistake #7 - Making Cash Donations Instead of Appreciated Stock

If you itemize your deductions, making charitable contributions can help reduce your tax bill.

If you work in tech, there’s a good chance that you’re sitting on stock that has appreciated significantly over the last few years.

Assuming this is the case, donating your appreciated stock is much more tax advantageous than contributing cash to charity.

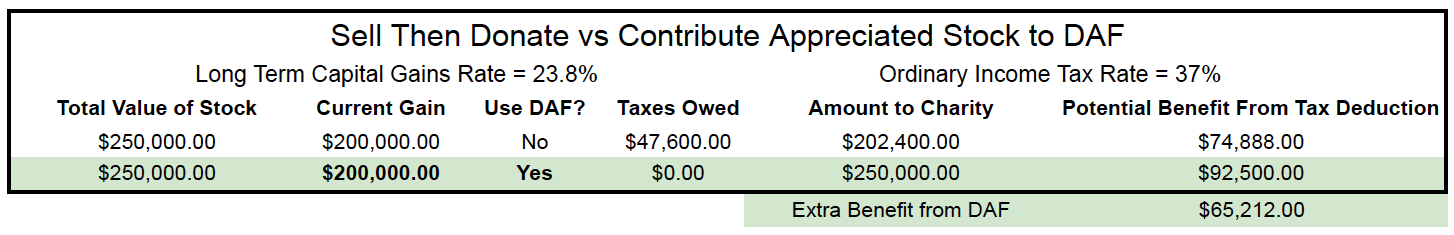

Here’s a look at the difference between making a charitable contribution of cash vs stock:

Simply by contributing stock or utilizing a Donor Advised Fund, you’re able to benefit ~$65k more than by contributing cash.

Final Thoughts on Tax Strategy Mistakes People in Tech Make

Not every item on this list is a “mistake” in the traditional sense, some are simply missed opportunities or inefficient tax strategies.

If you’re not intentional about planning and managing your equity, you could end up paying thousands more in taxes than necessary.

If you’re looking to avoid these mistakes/pitfalls and build a smarter tax plan, we’re happy to help. We provide advice without charging asset management fees (known as advice-only) and built our entire firm around serving people as transparently as possible.

Even if you don’t work with us, you’ll want to make sure your CPA and/or advisor is helping you stay on top of all of these things. As always, thanks for reading!