RSU Offset & Stock Offset on Your Paystub Explained

Reviewing each line item on your paystub can get confusing if you don’t know what you’re looking at. The line item that seems to trip people up more than most is the RSU Offset or Stock Offset line item.

To put it simply, this RSU and Stock Offset line item typically represents the net shares you received after your company takes out all relevant taxes when your RSUs vested. In other words, it’s the value of shares you actually received.

But it’s not quite as straightforward as this makes it seem.

Just a few problems:

Employers report things differently on paystubs

Employers can have different names for how they list RSUs, RSU offsets, and stock offsets

It’s hard to figure it out yourself unless you have an idea of what to look for.

The purpose of this article is to help you understand what an RSU offsets represent, teach you what to look for on your paystub, and share a few examples so you are better prepared.

Table of Contents ▼

Something as simple as understanding a line item on your paystub can go a long way in helping you make the most of your equity compensation. The more understanding you have, the better.

Quick Explanation of RSUs and Equity Compensation

Equity compensation broadly refers to all the ways employers can compensate their employees with stock.

Restricted Stock Units (RSUs) are one of those many forms of compensation.

Employers will give (aka grant) employees RSUs, and if they stay with the company long enough, those RSUs will turn into shares.

When RSUs become shares that the employee actually owns, it is a taxable event and the value the employee receives shows up on their paystub.

Other forms of equity compensation work differently than RSUs, but the gist is that since you’re receiving stock instead of a cash payment, some form of taxes will be determined.

What an RSU or Stock Offset Actually Represents

The thing that confuses people (and even some advisors) the most is what an RSU Offset actually represents. Complicating this further, the terminology and practices used by different tech companies can vary! (Examples in a bit.)

When RSUs vest, the full value of the shares is treated as income. That part is pretty straightforward.

But because RSUs have required withholdings, aka statutory withholdings, you will not directly receive the full value of the shares into your stock plan account.

A portion of those shares must be withheld for tax purposes.

To show this difference between what you’re taxed on and what you received, your payroll department needs to accurately reflect this in your paycheck.

This is where it is important to understand what the term RSU Offset or Stock Offset actually represents. Despite how it sounds, it is NOT:

The amount of tax withheld

The total value of the RSUs that vested

The number of shares sold to cover taxes

Your RSU Offset or Stock Offset represents the value of the shares that actually hit your brokerage account after a portion was taken out to cover taxes.

Why Is It Called an Offset?

The term “offset” sounds technical, and it is, but it means “to cancel out” or “reverse” a prior entry.

Since the income from your RSUs will show up on your paystub, the offset just communicates that you didn’t receive cash to your bank account and that instead you received the value to your stock plan account.

Even with other types of equity compensation, it can work similarly. The usage of the term “Offset” may be accompanied by a whole slew of words before or after it.

We’ve seen all of the following (and you may see them as well):

Stock Offset

Stock Tax Offset (shout out Spotify)

RSU Offset

RSU Deduction Offset

Broker Offset

ESPP Offset

ISO Offset

NSO Offset

The word “Offset” is most commonly used, but there are several different ways it can be referred to on a paystub.

If you’re unsure what something represents, just ask your payroll department, and they’ll be able to help clarify what you’re looking at.

What Taxes Get Taken From an RSU Offset

Since RSUs are treated as regular compensation, there are a handful of taxes that can be taken out. (The same can be said of other forms of compensation as well.)

Here’s a list of the potential taxes that can be pulled from your RSUs at vest (and please note that this can change based on where you live):

Federal income tax - Companies typically withhold at 22% until $1M then 37% after

State income tax - Varies based on the state. CA withholds at 10.23%. Some companies allow you to choose a percentage. Nvidia now lets employees choose their state withholding rate.

Social Security tax - 6.2% on earnings up to $176,100

Medicare tax - 1.45%

Additional Medicare tax - .9% once you surpass certain wage thresholds

Other state and local taxes - Varies based on where you live.

There are quite a few taxes that can be pulled from RSUs and other forms of equity compensation.

If for whatever reason you feel that the amount you’ve received is less than the amount you should have, you should first start by tallying up all the different taxes you’re paying.

Another important note here is that companies don’t withhold from non-employees who receive equity compensation in the same way that they withhold from employees or even former employees.

Examples of RSU Offsets on a Paystub

Now it’s time to get into some examples of how RSU Offsets, Stock Offsets, and all other variations of their names appear on actual paystubs. For clarity’s sake we’ve removed a lot of information from the paystubs and changed some values, but these examples should still prove helpful.

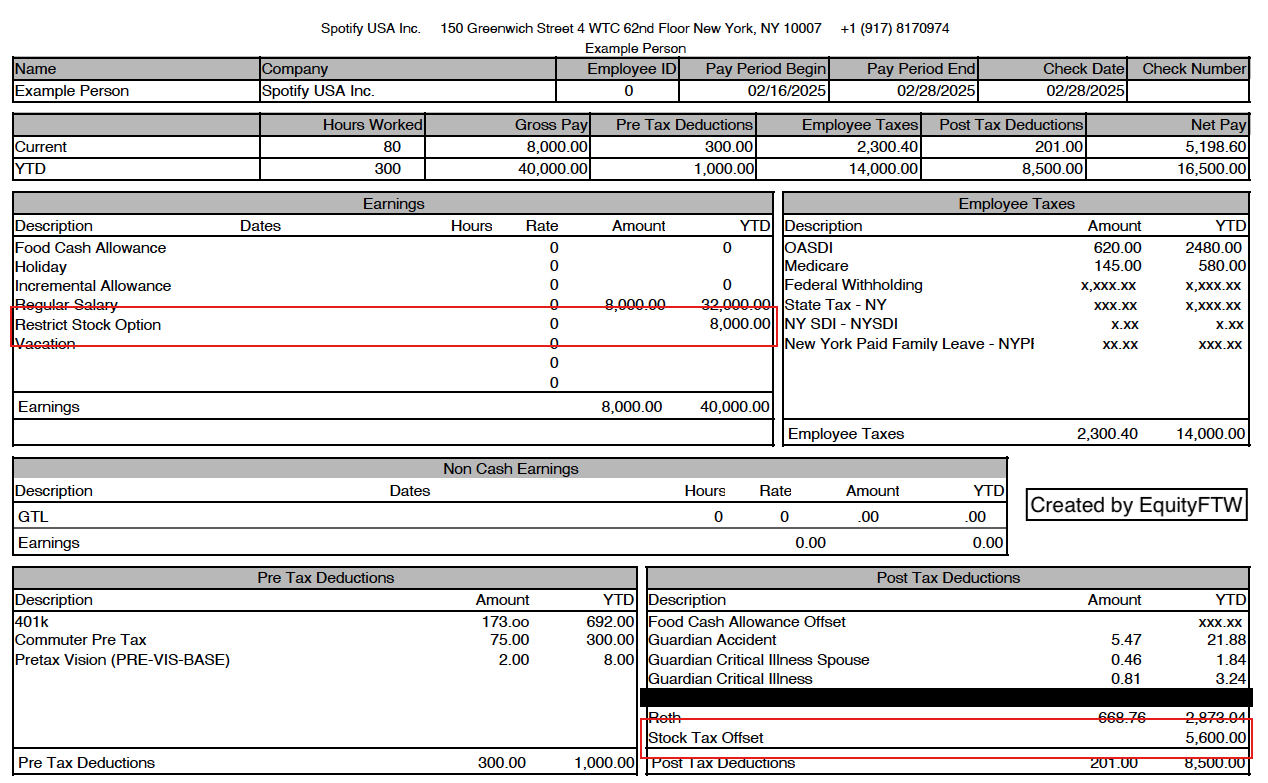

Restricted Stock Offset Example #1 - Spotify

Below is a screenshot of our first example with the two key line items highlighted.

Let’s start with the red highlighted box on the top left. This box highlights the phrase “Restricted Stock Option.”

What’s a Restricted Stock Option, you ask? Well, in this case, it refers to the RSUs that this person has had vest so far this year.

The number tied to this line item refers to the total pre-tax value of RSUs/shares that this person received. So even though it’s saying Restricted Stock Option, it really means a Restricted Stock Unit.

The second highlighted red box on the right shows the Stock Offset, listed as “Stock Tax Offset.”

This highlighted number refers to the total value of shares that the employee received after taking out all required taxes from the gross value.

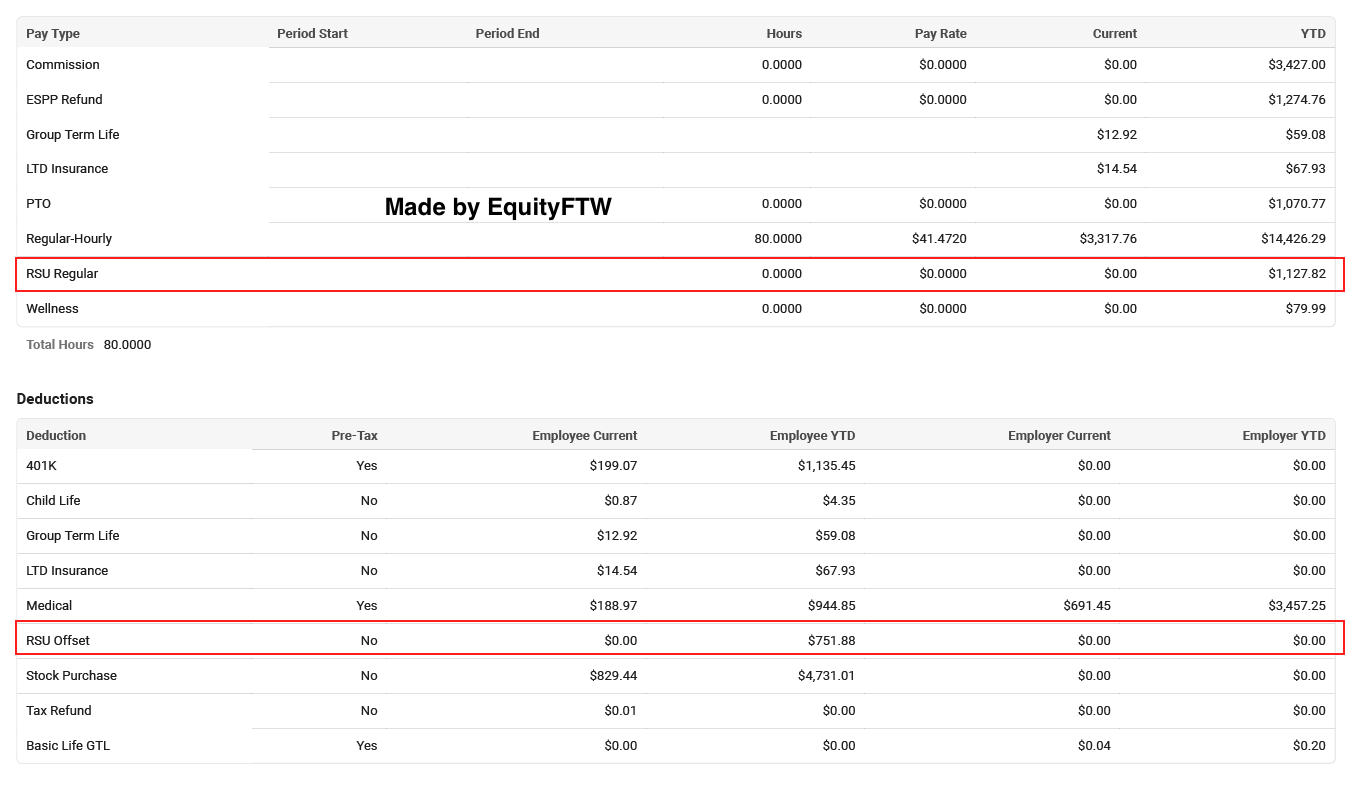

Restricted Stock Offset Example #2 - Adobe

Here’s an example of how paystubs at Adobe show the RSU offset.

The numbers are pretty small in this example, but it’s much easier to follow simply because the naming convention used by the payroll system matches typical language in the equity compensation world.

“RSU Regular” refers to the total pre-tax amount of RSUs received.

“RSU Offset” refers to the net value of shares this employee received.

Just like the Spotify example, there’s no activity on this specific paycheck, it’s just showing the total year-to-date activity of RSUs and RSU offsets.

If we were to add a third example it'd be from Apple showing how their RSU Tax Offset actually just represents the taxes paid on RSUs vs the net amount received. All the differences between companies is why the RSU Offset is a confusing line item.

Final Comments on RSU Offsets and Stock Offsets

Everyone likes to have an understanding of how they’re paid and when you go to verify everything’s correct, it’s helpful to be able to know what to look for. As we’ve reiterated, you’ll need to check how your specific company names your RSU payments and the RSU Offset.

Once you can properly review what’s on your paystub, it’s a helpful first step in avoiding an RSU double tax and calculating your taxes from RSUs.

At EquityFTW, we specialize in helping tech employees navigate RSUs and other equity compensation. We do it for a flat price (and in plain English) so you can make confident, informed decisions.