Dollar Tree’s ESPP is Almost Great

Employee Stock Purchase Plans (ESPPs) are one of the most underappreciated employee benefits. Because they’re so often underappreciated, they’re also usually underutilized. A perfect example of this underutilization is Dollar Tree’s ESPP.

Our bet is that, until now, most of you probably had no idea that Dollar Tree even offers an ESPP. You may be even more surprised to find out that it’s been a high-performing ESPP over the last 5 years.

Dollar Tree is unlike the tech companies we typically write about and their employee base isn’t the same either. Because of this, we’ll be interjecting a bit more opinion into this article. After doing a thorough examination of Dollar Tree’s ESPP, we’ve concluded that it’s good, but it’s missing a few key components that would flip our rating to great.

In this article we’re going to provide: (1) a quick overview of Dollar Tree itself, (2) an overview and explanation of all the key terms in Dollar Tree’s ESPP, (3) a discussion of why ESPPs are usually such a great benefit, and (4) a discussion of the ways in which we think Dollar Tree’s ESPP could be improved for its employees.

Overview of Dollar Tree

If you live in the U.S. there’s a good chance you’ve shopped at a Dollar Tree or Family Dollar (which was acquired by Dollar Tree in 2015). Combined, the two companies operate over 16,000 stores and have more than 200,000 employees. Of those more than 200,000 employees, ~60,000 are full-time and ~140,000 are part-time. This makes Dollar Tree one of the top 100 employers in the U.S.

In 2022, Dollar Tree sales totaled $28 billion. After paying all expenses and taxes, the company finished with a profit of $1.6 billion. Over the last several years, Dollar Tree has consistently improved its sales and profits.

Every decision a company of this size makes can have massive consequences for its employees. At EquityFTW, we believe that corporations are better off when they look after their employees and invest in the people who work for them. In our opinion, there is no better way to do this than by helping employees understand basic personal finance and giving them the opportunity to harness the power of owning equity.

Overview of Dollar Tree’s ESPP

Before we begin our dive into the basics of Dollar Tree’s ESPP, please note that detailed information was not readily available so if you have a correction please let us know so we can make updates.

In general, we found that most Dollar Tree employees are unaware of the opportunity they have to participate in the company’s ESPP. As evidence, Here’s a Reddit thread of us asking Dollar Tree associates about their ESPP and another Reddit thread of someone asking for more details about Dollar Tree’s ESPP.

In fact, Dollar Tree’s ESPP is only mentioned once in plain language (i.e. not in a financial statement) in their Annual Report and again only mentioned once in their Sustainability Report. (The same wording is identical in both reports.) As you’ve likely already guessed, this is an area we’d recommend that Dollar Tree leadership pay some attention to.

That said, every ESPP is required by the IRS to include certain features in order to qualify as a proper, qualified ESPP. Beyond these basic requirements, companies have the ability to choose to offer better ESPP benefits and features (within certain specified IRS guidelines).

Most of Dollar Tree’s ESPP features fall in line with what’s standard; however, there are a few features that are not standard (including some that are not necessarily favorable) so we’ll address these next.

Dollar Tree ESPP Eligibility

In order to participate in Dollar Tree’s ESPP, employees must meet a few basic requirements:

Work at Dollar Tree or a company owned by Dollar Tree

Work either full-time or part-time

Be employed there for 3 months or more

Opt-in to participate (Dollar Tree does not enroll employees automatically.)

These are pretty straightforward requirements. As long as you’ve been employed by Dollar Tree, have been there for a quarter of the year, and you officially opt-in, you’ll be able to participate.

Dollar Tree ESPP Purchase Period

A purchase period is the time period in which a company allows its employees to save up to buy company stock. At the end of the purchase period, you use that money that has been set aside to purchase stock.

Dollar Tree offers purchase periods of three months and has four of them per year. This means that for three months, you’ll set aside money from each paycheck, then at the very end, you’ll use what you’ve saved to purchase Dollar Tree stock.

Six months is the standard purchase period, so offering this quarterly is significant. It’s one of the positive things about Dollar Tree’s ESPP and we love it.

Dollar Tree ESPP Offering Period

An offering period is a set amount of time in which a company will let its employees purchase stock. They’re commonly 6 months long and will match the length of the purchase periods, but offering periods can be longer if companies want to provide a larger benefit.

Dollar Tree’s Offering Period matches its Purchase Period at 3 months (every quarter).

Here’s an example of how the offering period and purchase periods line up at Dollar Tree:

The quarterly frequency is nice because it gives employees the opportunity to test the waters of the ESPP process without having to commit to a full 6 months. Again, we love the idea of quarterly windows for employees.

Dollar Tree ESPP Discount

A big incentive for participating in an ESPP is that companies will provide their employees a discount when it’s time to purchase company stock at the end of each purchase period. These discounts range from 5% to 15%.

Many companies offer the max discount here, and so does Dollar Tree. That max discount of 15% may not seem like a huge benefit, but the opportunity to lock in a 15% gain every 3 months is pretty fantastic.

Dollar Tree ESPP Lookback

An ESPP lookback is when a company applies its stated discount to either the price per share at the end of the purchase period or the price at the beginning of the offering period.

This is the benefit that makes ESPPs particularly great so it's a big benefit Dollar Tree offers a lookback.

This means that if Dollar Tree’s stock price were to go up over the quarter, a lookback gives employees the option to purchase that stock at its lower price per share all the way back at the beginning of the quarter.

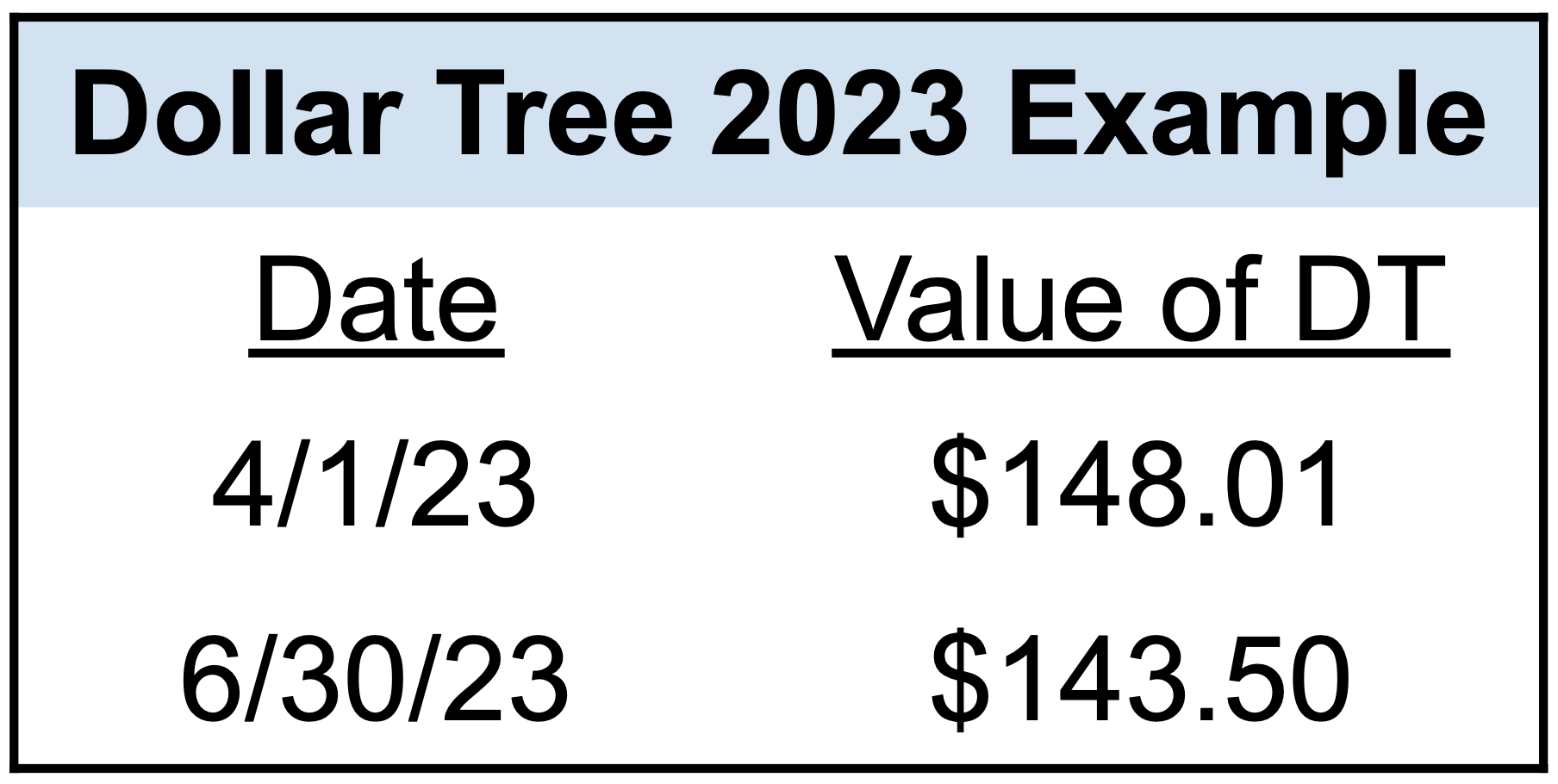

It’s not a perfect example, but let’s look at Q2 of 2023:

As you can see, Dollar Tree started the quarter at roughly $148 a share. At the end of the quarter, the price per share had dropped to $143.50.

A lookback means that the 15% discount would apply to whichever price is cheaper. In this case, because the stock price went down, the lookback would not be applied. ESPP participants in this example would be able to take 15% off of $143.50 and purchase Dollar Tree shares for $121.975 each.

Had the price gone above $148, participants still would’ve been able to get 15% off of $148, meaning they’d be getting an even better deal. Once another quarter has passed, we’ll update this example to reflect the lookback more accurately.

Dollar Tree ESPP Contribution Limits

The IRS sets a limit on how much an employee can contribute to an ESPP, but employers can also set limits of their own and may limit how much their employees can contribute by establishing a maximum percentage of employee wages that can go toward their ESPP.

The IRS limit for how much an individual employee can contribute to an ESPP in a given year is $25,000. (Because of the way the discount works, the true limit is $21,250, but you don’t have to worry about that math.)

Dollar Tree also limits ESPP employee contributions to 10% of that employee’s wages. This percentage limit can be pretty restrictive as most part-time employees are making enough to even come close to the match. That said, it’s also likely maxing out an ESPP would hurt the employee’s monthly cash flow if he/she isn’t careful.

Offering Period Reset

In an offering period reset, companies will automatically set your new offering period if the price at the purchase date is lower than at the beginning. However, this is only applicable when the offering period is longer than the purchase period and when the company has an offering period of 12 months or greater.

Since Dollar Tree’s ESPP has short offering periods, it doesn’t make as much sense to offer a reset, and they don’t.

Fractional Share Purchasing

Some companies allow you to purchase partial shares of the company so every dollar you contribute to the ESPP will be used.

Say your purchase price in your ESPP ends up being $150. If you had $290 set aside, you’d be able to buy 1.88 shares. If there was no fractional share purchasing, you’d be able to purchase one share and the remaining $140 would be refunded to you.

Dollar Tree unfortunately does not offer fractional share purchasing, but it’s not by any means a deal-breaker. Fractional share purchasing is merely a nice-to-have.

One Year Lock-up

Based on the employees we’ve spoken with and the documents we’ve reviewed, Dollar Tree’s ESPP requires employees to hold shares purchased through the ESPP for one year before they can sell.

This is a very rare, and not particularly employee-friendly, stipulation.

In our view, this requirement completely undermines the benefit of having an ESPP. Employees already have to tie their money up for a whole quarter, but to force them to hold shares and tie money up for a whole year removes all flexibility that most ESPPs offer.

We’re not exactly sure why Dollar Tree requires a one year lock-up, but perhaps they want shareholders to stay shareholders for a long time and maybe that’s why they’ve instituted a one-year lock-up?

If ESPPs are meant to be a benefit to the employees, why not let it truly be a benefit to the employee? Requiring a one-year holding period after purchase greatly reduces the power of this “employee benefit.”

Why ESPPs Are Usually Great

We write about ESPPs all the time because they are one of the best employee benefits employees can receive. This isn’t an exhaustive list, but here are a few reasons ESPPs are usually great:

#1 - They act like an automated savings account

Because funds are deducted from your paycheck every month, you don’t even have to think about contributing, you just do. This set-it-and-forget-it feature helps you save and invest automatically.

#2 - They link employees to company stock.

When companies do better and grow, usually those companies’ stock prices go up. Companies want employees to feel motivated to help improve the company and share the same vision. The best way to do this is by giving employees opportunities to receive equity.

Other forms of equity are also great, but an ESPP is a fantastic place to start by giving employees the ability to own company shares.

What’s interesting is company leadership at Dollar Tree not only get paid great salaries, they also receive significant compensation in the form of equity. Dollar Tree’s CEO, Richard Dreiling, in 2022 opted for a grant of 2,252,937 Non-qualified Stock Options (NSOs) instead of a larger salary or other types of equity. In order for his NSOs to be worth anything, he needs to stay at Dollar Tree for several years and for Dollar Tree’s share price to increase above $157.17. Anything over that is potential gain. If Dollar Tree one day reaches $200.17, his grant of equity would be worth $43 multiplied by his 2,252,937 NSOs. The CEO is incentivized to increase Dollar Tree’s share price over time. Clearly, employees should hop on board as well!

#3 - Participants can sell at an immediate profit.

In most cases, ESPP participants can sell the shares they’ve purchased either during the next trading day after purchase or during an open trading window (which is usually quarterly and following an earnings call).

Being able to sell ESPP shares quickly enables employees to lock in gains for whatever they wish to sell and use the proceeds however they’d like. (This type of sale is known as an ESPP disqualifying disposition.)

#4 - They are a relatively safe way to introduce employees to investing.

In our opinion, ESPPs are great for introducing employees to the world of investing. If companies want their employees to live happy lives and to be able to one day retire, they should encourage every employee to learn how to invest.

ESPPs provide a fun way for employees to do just that. Employees can begin tracking their company stock price, see the volatility, and begin to look at other, more diversified methods of investing. Even if selling ESPP shares leads to purchasing a broad index fund, that shouldn’t be frowned upon by those managing the ESPP.

Three Recommendations to Improve Dollar Tree’s ESPP

We may be able to think of more, but three easy recommendations come to mind if Dollar Tree would like to improve its ESPP.

#1 - Improve awareness and increase employee understanding of the ESPP.

If you were to do a poll, we’d guess that less than 75% of part-time employees realize they’re eligible to participate in the ESPP. With 140k part-time employees, that’d be over 100 thousand people who don’t know that they have access to a great benefit.

The fact that Dollar Tree’s ESPP is only mentioned once in non-financial reporting terms on their Annual Report and mentioned only once again in their Sustainability Report is frankly, sad. There is much room for improvement on the awareness front.

Unfortunately, just promoting and stating that you have an ESPP isn’t enough. Any additional promotion of the ESPP should come with a large push to increase employee understanding of personal finance and how the ESPP works.

#2 - Remove the One-Year Lock-up

It is not standard to have a one-year lock-up, and the ESPP plan itself has language that would allow for the removal of the lock-up.

If you think about the employees working at Dollar Tree, there are many who can’t afford to participate in the ESPP and have their money tied up for a year.

Even if removing the lock-up lead to employees selling shares on the open market after purchase, that should still be seen as a good thing because it means employees are receiving a benefit! And isn’t that kind of the whole point of providing employees benefits?!

#3 - Increase the 10% Max Contribution

The max contribution of 10% is low. For someone to be able to contribute up to IRS maximums in the ESPP they would need to make over $200k a year. There is probably not a single part-time worker making that much in the entire company.

If employees want to be able to contribute more, they should be able to. Our recommendation would be to allow for up to 25%.

By implementing these three recommendations, we’re confident that employee ESPP participation would improve. Perhaps more importantly, these changes would turn Dollar Tree’s ESPP into something truly beneficial for employees.

Final Thoughts on Dollar Tree’s ESPP

There are many factors to consider when weighing big changes to a company’s ESPP policies. Dollar Tree is an especially interesting case because although they recently had profits of over one billion dollars, they don’t have massive margins. Meaning that each and every cost needs to be looked at closely. While changing their ESPP in the ways we’ve described might cost Dollar Tree some money, it’d be really interesting to see how making these changes would impact employee retention and job satisfaction. (Our guess is that both areas would improve!)

We’re happy to review Dollar Tree’s ESPP with their executive team and provide some financial training to their employee base. Heck, we might even consider doing it for free.

In the meantime, if you’re a Dollar Tree employee and are trying to decide whether or not to participate in your company’s ESPP you need to carefully weigh how much cash you need now vs later. And you need to weigh whether or not you’re okay with stock price movements in Dollar Tree. If you’re a part-time employee struggling to make ends meet, the one-year lock-up probably makes the ESPP unusable. If you’re saving money and have excess every month, then it might make sense to contribute to Dollar Tree’s ESPP, but you’ll want to take some time to thoroughly assess the decision. (We’ve written a detailed article, “How Much Should I Contribute to My ESPP.” You might find it helpful.)

Thanks for reading and as always please feel free to reach out with questions or comments below!