Restricted Stock Unit (RSU) Basics

If you work in tech, it’s likely that you’ve heard the term “RSU.”

RSU is an acronym for “Restricted Stock Unit.” Removing the abbreviation probably doesn’t help you understand it more, so let’s explain further.

Your company has different ways to pay you. (1) It can pay you with cash, (2) it can pay you by providing you a benefit, or (3) it can pay you by giving you company stock.

If you’re receiving Restricted Stock Units (RSUs) from your company, it’s paying you in the form of company stock.

What Is a Grant of RSUs?

Each instance your employer gives you RSUs, it’s called a Grant. If a company gives its employees RSUs, it is common for a grant to be given when you first start at a company, when you get a promotion, or if you’ve achieved a significant performance goal. You can even have yearly grants of RSUs as part of your pay (these are commonly referred to as “refreshers”).

Why Do Companies Give RSUs?

The short answer to this question is that RSUs give employees a way to own a piece of the company. And it turns out that people who own stock of the company they work for end up enjoying work more.

This is why companies that have the ability to give RSUs love to give them to their employees. We recommend politely asking for RSUs as often as isn’t annoying. (Please don’t be annoying.) If you’re in the middle of negotiating with a recruiter, or negotiating a raise during your annual performance review, you’re in a great position to ask for a grant. Here’s an article discussing how to politely ask for RSUs. Understanding RSUs will give you a little more bargaining power and maybe some additional confidence as well.

How Does Getting RSUs Work In Practice?

With each grant you receive, there will be terms that both you and the company agree to. These terms are laid out in what’s called a Grant Agreement.

There are lots of important details found on a Grant Agreement, but the two most important things for beginners to look at are:

How many shares/units you’ve been granted

How and when your shares/units will vest (become yours)

Understanding your Vesting Schedule is very important both from an ownership perspective, but also a tax perspective. Some vesting schedules will look at performance goals, but typically they are based strictly on time employed.

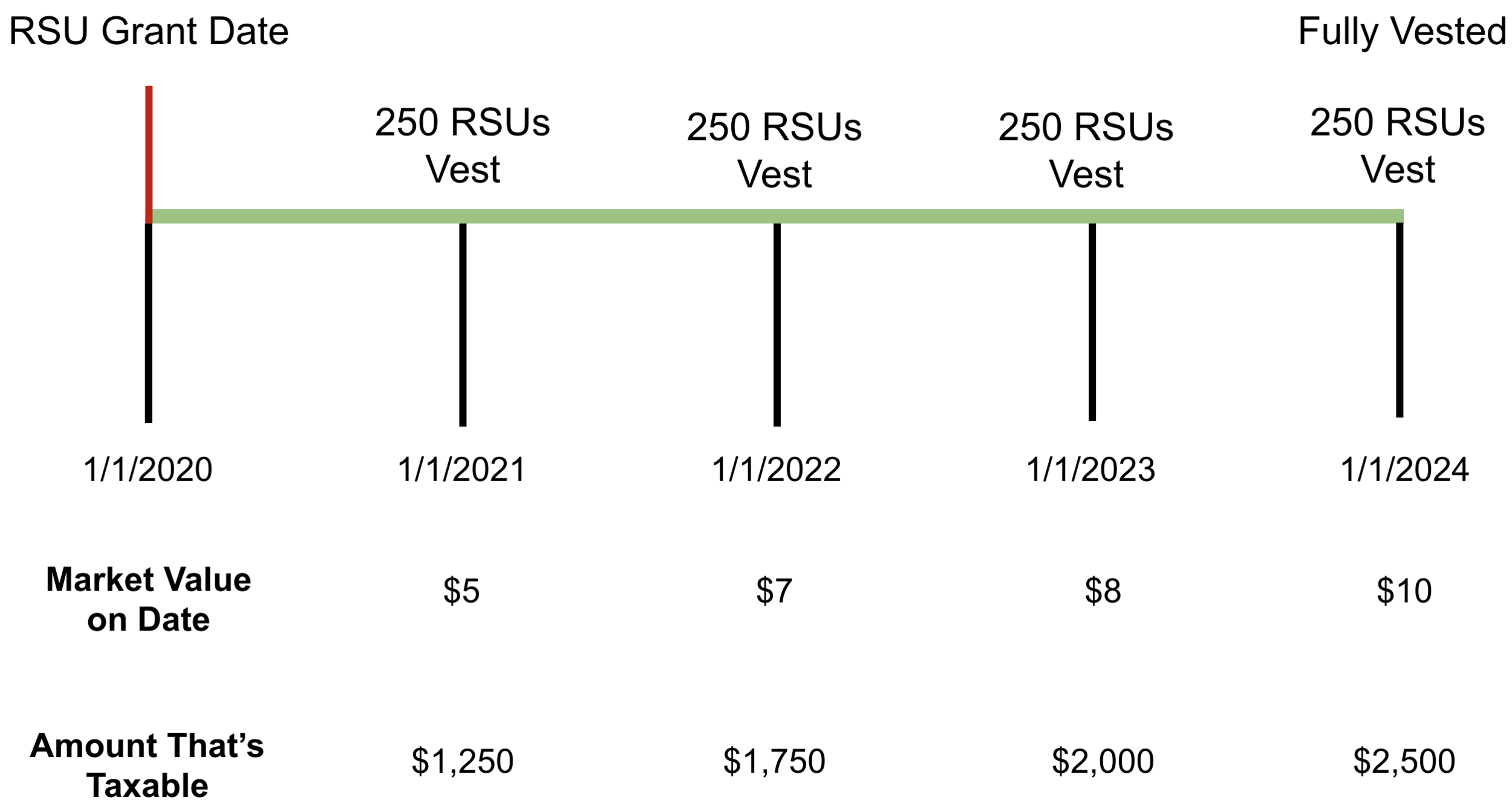

The most common vesting schedule we see is a 4-year vesting schedule. Meaning that even though the company may grant you 1,000 RSUs, only 250 will become yours each year.

Let’s say you receive a grant of RSUs on Jan. 1 2020 with a 4-year vesting schedule. This is what that looks like:

Sometimes companies will make things a little more beneficial by giving you monthly vests after the first year. Which looks like this:

At each of these vesting dates, these RSUs become yours and the company stock becomes yours as well.

What Do I Have To Pay?

Remember, RSUs act as a form of payment from your employer to you. You will not have to pay to purchase the shares, but you will have to pay taxes on them.

Your employer will usually withhold taxes as your RSUs vest and become yours. In most states, the amount the employer withholds will be enough to cover taxes, but if you're an especially high earner, it’s likely your company isn’t withholding enough. We’ve discussed this topic in our “RSU Tax Rate” article and have covered it in our “When Do You Owe Taxes on RSUs” article as well.

As each portion of the RSU vests, that portion becomes taxable. If you have 250 RSUs vesting this year, you’ll take that amount (250) and multiply it by the market value of your company on the date of vest.

Let’s take an example from above, but this time we’ll look at the vesting schedule and the potential taxes that are.

Paying taxes is painful, but paying taxes because you’re making more money is certainly something you can live with.

NOTE: You won’t pay the taxable amounts above, you’ll pay a percent of the taxable amounts listed above, and typically your employer will withhold taxes for you (like they do with your salary).

Do You Want RSUs?

Absolutely. If you haven’t received any, you can ask politely. RSUs are a great way for you to grow with the company you work for and should help you feel a larger sense of ownership (as having a vested interest in your company literally makes you a partial owner).

Obtaining ownership/equity of a company is how you begin to create wealth. Cash compensation is great, but the more equity you can own, the quicker you’ll be able to grow your net worth and become financially independent.