When to Use an Exchange Fund

The stock market has a history of going up over time. Some stocks go down, some stocks go up, and some stocks go up so much it causes the thought, “I’m an idiot for not putting all of my money in this.” If you’re one of the lucky few with large sums of money in a stock that’s appreciated beyond what you ever imagined possible, using an exchange fund could be a brilliant move that saves you hundreds of thousands of dollars in taxes.

The purpose of this article is to give an overview of exchange funds, when it makes sense to use exchange funds, and when not to use exchange funds. Exchange funds have been around for a long time, but it has been only recently that companies have made them feasible for consumers.

If you’re currently holding stock that has hundreds of thousands of dollars or more in gains, it’s worth the time and effort to learn about exchange funds and their potential benefits for you.

What is an Exchange Fund?

An exchange fund is a collection of highly-appreciated stocks from a group of investors. Each investor takes their highly-appreciated stock, contributes it to the fund, then in return, is given a slice of the fund.

To break it down more simply, let’s talk in terms of pizza.

Let’s say that Peter orders pepperoni, Charles orders cheese, Vanessa orders veggie, and Brooke orders BBQ chicken.

Everyone is excited about the pizza, but they don’t all want to eat the entirety of their individual pizza. Instead, they each cut their pizza into fourths and share slices amongst the group. After everyone’s traded slices, they all have one slice of each flavor.

Exchange funds are made from shares/slices of stock being pooled with people who are willing to share their own shares/slices of stock. As you’ll learn shortly, this can be hugely beneficial because it enables you to diversify into different stocks without having to sell and pay taxes on all of your gains.

Benefits of an Exchange Fund

There are four primary benefits to using an exchange fund. Which benefit will provide the greatest advantage may vary from person to person, so the following list is not in any particular order.

1st Benefit of an Exchange Fund - Diversification

When you trade in your appreciated stock for shares of the exchange fund, you drastically reduce the downside risk you’re exposed to.

Exchange funds vary in size, but let’s say you trade in your single holding for shares in an exchange fund that holds 100 different companies. The odds of one successful company going out of business is low, but the odds of 100 successful companies going out of business is extremely low.

If you own a stock that has appreciated substantially, there’s a really good chance that it's by far the largest holding in your investment portfolio.

It’s great that your stock has appreciated so much, but there are some questions that you should ask yourself.

How do you feel owning so much of just one single stock?

If it were to drop in value by 40-50% what kind of impact would it have on your future financial goals?

If you could experience returns at a relatively steady 7-8% on average per year, would you still feel the need to stay heavily invested in your company?

Would you be able to live with yourself if your stock were to continue to appreciate rapidly and you missed out?

There’s a saying that concentration builds wealth and diversification preserves it. If you’ve already hit the jackpot with one particular stock, it may not be worth the risk to continue to let so much ride on one holding.

2nd Benefit of an Exchange Fund - Tax Avoidance

When you swap your stock for shares of the exchange fund, this action does not trigger taxes.

Normally, if you wanted to diversify out of a single large position, you’d expect to pay taxes on any gains you experienced in order to do so. Typically, the greater the gains, the greater the taxes you can expect to pay. But this is not the case with an exchange fund.

For example, the highest federal long-term capital gains rate is 23.8% and in some states like CA, the highest tax rate is 13.3%. This means that if your gain is large enough and you live in CA, you could pay a 37.1% tax just to diversify!

With an exchange fund, you can set the tax piece aside (at least at the beginning).

3rd Benefit of an Exchange Fund - Growth From Avoided Taxes

By avoiding taxes as we discussed above, your diversified portfolio begins with a larger value, which means that it has the opportunity to grow faster. The taxes you’ve avoided can then be used for growth instead of going to the IRS.

Here’s a simple example to help illustrate:

Let’s say you have a $1M position with a $900k gain. Let’s compare portfolio values in 7 years after paying 0% in taxes now vs paying 23.8% now. (To make the comparison fair, we’ll have the 0% tax now scenario pay 23.8% at the end. Assumes a 8% rate of return.)

As you can see in this example, by initially avoiding the 23.8% tax and waiting 7 years to sell, you’d end up making over $115k more when compared to paying tax immediately.

We know this example is far from perfect, but it does serve to illustrate the benefits of tax-deferred growth.

As you continue reading, we’ll provide several more examples of using exchange funds specifically.

4th Benefit of an Exchange Fund - Improved Tax Planning

The next big benefit of using an exchange fund is that you will have full control over when you ultimately sell and pay taxes.

This may seem like only a marginal benefit, but it’s extremely powerful if executed properly.

When people own large concentrated positions, the temptation is to sell everything (or most everything) all at once because it’s hard to guess where the company stock price will go. However, if the position is large enough, selling everything will push you into higher tax brackets.

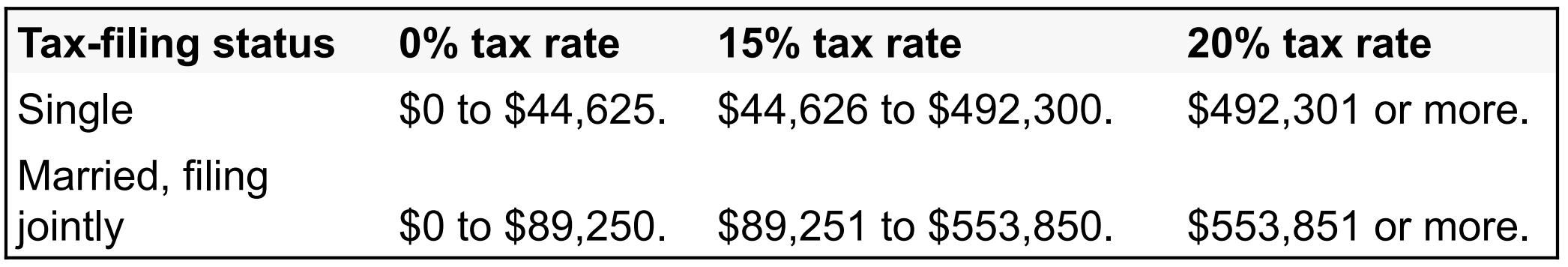

Here’s what the long-term capital gains tax rates are for 2023 so you can orient yourself.

As you look at the rates in the above chart, you’ll see that there’s significant wiggle-room in the amount that can be sold in the 15% bracket before jumping up to 20%. And should you decide to take a sabbatical, it’s quite possible that you’d be able to stay in the 0% tax rate if you were to simply limit how much you sold each year.

Having the flexibility to optimize for taxes is really only afforded because you went from having one single position to a diversified portfolio. Once you have a more diversified portfolio, you’ll feel less pressure to sell everything all at once and can plan for tax with less tension.

Rules to Know About Exchange Funds

As you would expect, there are strict regulations regarding how exchange funds work. The impact of these rules will vary based on a number of different factors. We’ll cover some of the important basic rules but won’t cover them all. Once you find an exchange fund provider to work with, we recommend having them go over all the rules with you in detail.

You must be an Accredited Investor to participate.

An accredited investor is someone who has $200k+ of income if single, $300k+ of income including spouse/partner, or a net worth over over $1M (excluding their personal residence).

It’s important to note that some exchange fund providers have further requirements beyond those of an accredited investor qualification (i.e. you must be considered a Qualified Purchaser).

There is a 7-Year holding period requirement.

This is probably the most important rule to be aware of. The IRS requires that those participating in an exchange fund hold their investment in the fund for 7 years. If you don’t stay invested for the full 7 years, you’ll likely be subject to taxes, penalties, and will receive your shares back at their original value or at the funds current value if lesser.

The fund must hold an illiquid asset (usually real estate).

There’s a tax law requirement of all companies offering exchange funds to hold at least 20% of the total fund in qualifying illiquid assets like real estate. Whichever company you choose, you’ll want to feel comfortable with the particular strategies they use to manage that illiquid portion of the fund.

Ownership comes in the form of a limited partnership.

When the fund is created, it’s created by the group of investors making contributions into a partnership. In turn, they receive their fair share of the partnership based on what they contributed.

One of our favorite exchange fund providers is a fintech company called Cache. They offer a detailed explanation of exchange funds and describe the rules above in much greater detail.

Best Time to Use an Exchange Fund

The best time to use an exchange fund will vary from person to person, however if you (1) have over $200k in unrealized gains, (2) have the ability to hold onto the exchange fund for 7 years, and (3) are currently in a high tax bracket, it’s a strategy worth serious consideration.

Here are two examples illustrating the ideal time to use an exchange fund.

When to Use an Exchange Fund Example #1

Building off of our earlier example showing the benefits of delaying taxation, we're now going to go over examples of what your situation might look like if you were to use an exchange fund.

In this example below, you’ll see three differences.

The first difference is that we switched from using the words gain, to tracking the cost basis. We’re still assuming there’s a $900k gain, you just have to do a little mental math to get there.

The second difference is that since it’s not free to participate in an exchange fund, we’re assuming that your annual return will be .8% worse than if you had chosen to diversify on your own.

The last difference you’ll notice is that there’s a reduced tax rate after the exchange fund’s holding period requirement is met. This assumes that you’ll try to time your taxation so you stay in the 15% long-term capital gains bracket.

Even with a reduced return, the deferred taxation and the reduced tax rates result in $135k more dollars. And the benefit can be even greater as you’ll see in the next example.

When to Use an Exchange Fund Example #2

This next example is similar to the first exchange fund example, except this time we’ll assume that the individual is in the highest tax brackets in California, which in terms of long-term capital gains, would be 37.1%.

It further assumes that the person using the exchange fund moves to a state where there’s no income tax and ultimately avoids taxation in California at the end of the 7 years.

Given the change, the exchange fund now provides a benefit of over $325k!

When Not to Use an Exchange Fund

The previous examples show the potential value of using an exchange fund. However, it’s important to caution that you will need to evaluate your own situation and carefully vet the exchange fund you choose before you proceed.

Exchange funds can go from being a great tool to being an expensive way to tie your money up for 7 years. That’s not something to take lightly.

We’ll now discuss two examples of when not to use an exchange fund.

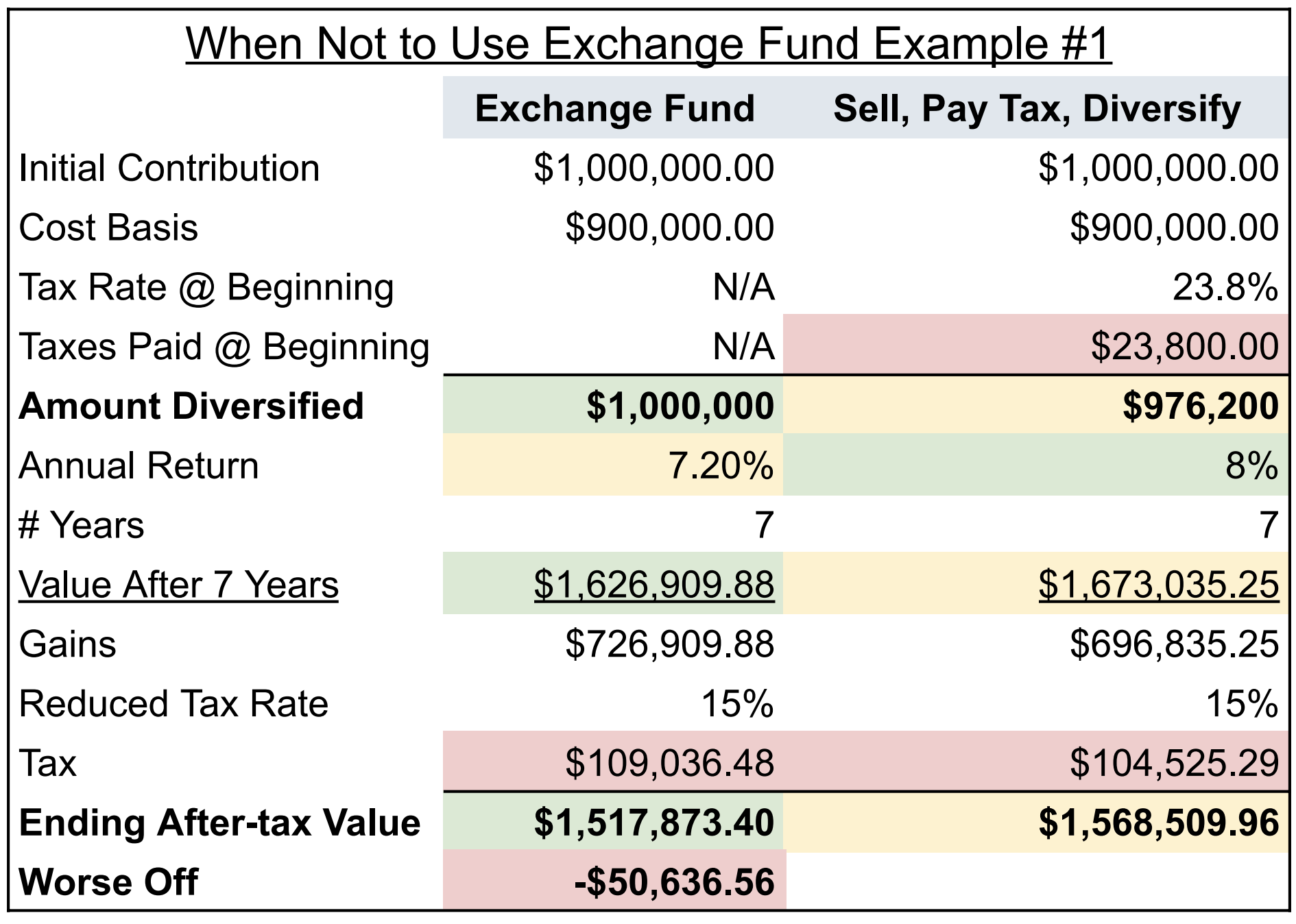

When Not to Use an Exchange Fund Example #1 - Limited Gains

The first example of when you wouldn’t want to use an exchange fund is if you don’t have sufficient gains to warrant the cost.

In the following example, we’ll assume that the exchange fund participant has a gain of only $100k in their single stock.

We recognize that saying “only $100k” may come across as sounding privileged. But in the case of exchange funds, a $100k gain might not be enough to warrant using an exchange fund. In the above example, using an exchange fund would leave you ~$50k worse off and you would have still had to keep your money in the fund for 7 years.

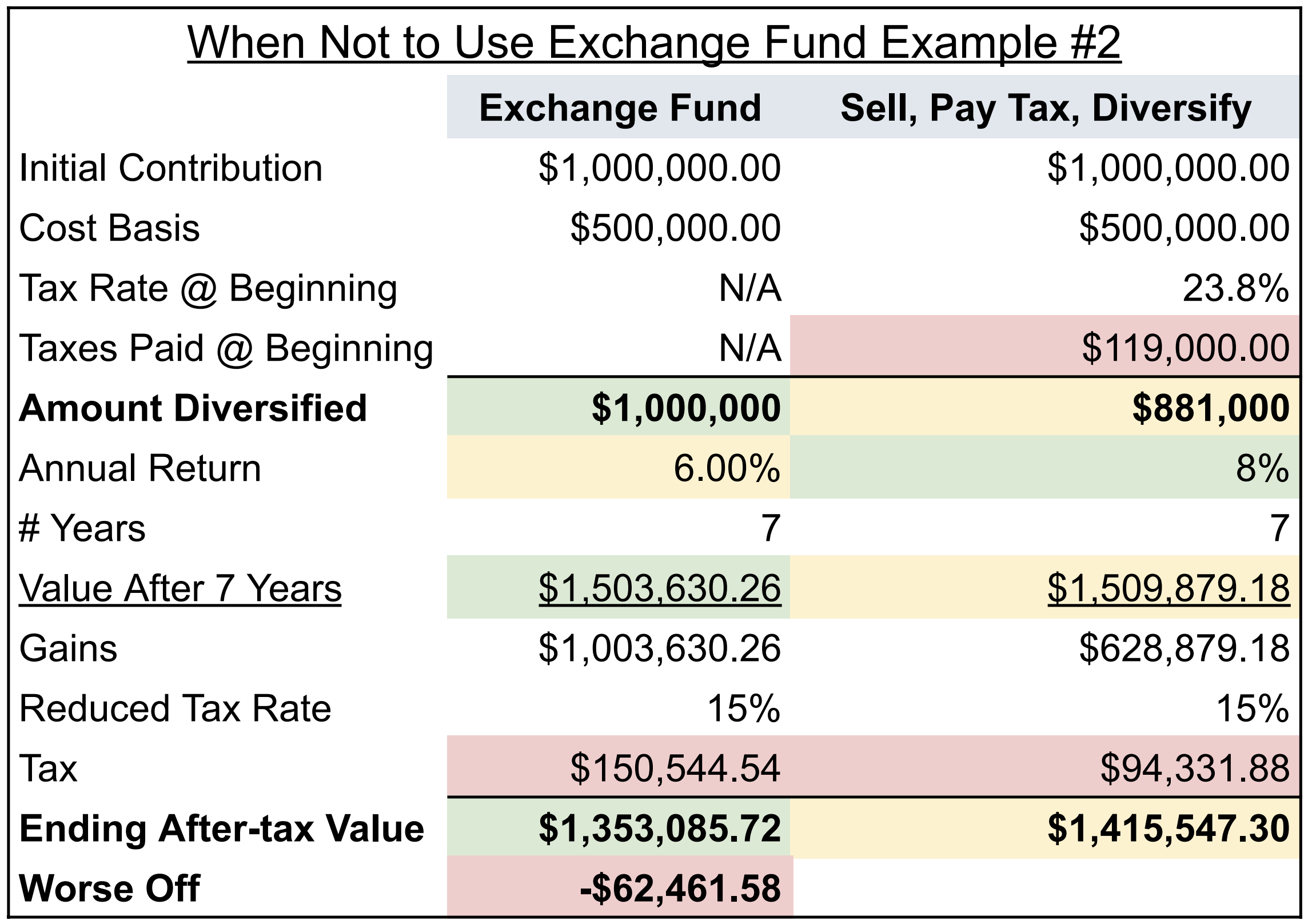

When Not to Use an Exchange Fund Example #2 - Too Many Expenses

The next example of when not to use an exchange fund illustrates how sensitive exchange funds can be to the fees that are charged by the provider.

Typical providers charge around 1-2% of whatever you contribute, but it can be even more if you’re using an advisor who also wants to bill on the assets as well.

Here’s what a 2% reduction in returns would look like if you have a $1M position with a $500k gain going into the exchange fund.

Even with $500k of gains, a 2% drag ruins the viability of using an exchange fund. In this example you’d be ~$62k worse off for having participated.

There are other scenarios we could provide, but the two we’ve included illustrate just how important it is for you to do your own due diligence. You’re likely to find exchange fund providers that amplify their assumed returns to highlight the absolutely best tax scenario. This makes it even more important that you run your own numbers.

Process for Using an Exchange Fund

You’re probably now wondering how the process works to get into an exchange fund.

Here’s how it typically works:

Find a brokerage that facilitates the building of an exchange fund.

Asset management firms like Goldman Sachs and Eaton Vance offer the ability to do exchange funds. The fintech company we mentioned earlier, Cache, has an extremely competitive offering as well.

Tell the brokerage about your appreciated asset and express interest.

Exchange funds have to be built collection by collection. They are not readily available for your appreciated stock at any given moment.

Wait for the firm to find others interested in an exchange fund.

After you’ve shared your details and expressed interest, you must wait until the brokerage has found enough interest so that it can build a fund that’s adequately diversified.

Accept the offer once they call.

Once the exchange fund has enough people committed, they’ll ask for a formal acceptance and will have all the legal documents ready to go.

Move your stock position into the exchange fund.

Receive shares of the fund based on your ownership of the fund.

Hold those shares for 7 years.

At the end of the 7 years, you’ll receive a collection of the underlying shares as your ownership converts.

Do as you wish with your shares.

Final Thoughts on When to Use an Exchange Fund

Exchange funds can be an extremely powerful tool in managing a large concentrated stock position if and when they are used properly. Saving hundreds of thousands of dollars in taxes is always worth consideration, but it requires the due diligence necessary to ensure that it’s going to be worth it for you.

We’ll reiterate that the best time to use an exchange fund is (1) if you have significant gains (usually over $200k at least), (2) you don’t have immediate cash needs and can wait the full 7 years, and (3) are currently in a high tax bracket or have gains so large it’d push you into a high tax bracket.

Thanks as always for reading. If you need help vetting an exchange fund for yourself, we’re happy to share our thoughts.