Salesforce’s ESPP is Worth Maxing Out

Employee stock purchase plans (ESPPs) are a common employee benefit that companies offer to their employees. In fact, they are so common that we like to analyze company-specific ESPPs to determine how great (or not great) they are. The purpose of this article is to take a deep analytical dive into Salesforce’s ESPP and share why we feel it’s worth maxing out.

Given that we’re discussing the specifics of Salesforce’s ESPP, we won’t dive super deep into the basic concepts of ESPPs. We’ve written articles about ESPP Basics, When to Sell ESPP Shares, and How Much You Should Contribute. So if you’re new to ESPPs, we recommend reviewing those articles first.

Let’s dive into how Salesforce’s ESPP is structured so we have a better understanding of what it has to offer.

Salesforce ESPP Purchase Period

A purchase period is the time in which employees participating in an ESPP set money aside with each paycheck until the very end of the purchase period. At the very end, the money that’s been set aside is used to purchase company stock.

The industry standard for the length of a purchase period is 6 months and Salesforce’s ESPP falls right in line. Salesforce offers a 6 month purchase period for those contributing to their ESPP.

Salesforce ESPP Offering Period

An offering period is the period of time that the company will allow employees to purchase company stock. It’s usually the same length of time as the purchase periods, but it can be longer if the company is wanting to provide a bigger benefit to its employees.

Salesforce’s offering period is a full 12 months, and within those 12 months are two purchase periods every six months. As you’ll see in the examples, this 12 month offering period makes it easier to experience large gains from participating in the ESPP.

Here’s an illustration to help show what it looks like:

Salesforce ESPP Discount

The biggest reason to contribute to an ESPP is because there’s usually a discount given to the employees purchasing stock. Typically discounts in ESPPs range from 5% up to 15%.

The majority of tech companies offer the maximum discount here, and Salesforce does too. Salesforce’s ESPP offers a 15% discount.

This may not seem like that big of a deal, but the reality is that you can receive a value much greater than just that 15%.

Salesforce ESPP Lookback

An ESPP lookback is where the company will apply the discount to either the price per share at the end of the purchase period or to the price per share at the beginning of the offering period - whichever is cheaper.

This is where the ESPP becomes really appealing. If Salesforce only goes up over 12 months, ESPP participants will be able to buy at the low point back in Month 1 plus get a discount on top of that!

Once we get into the examples showing the actual performance of Salesforce’s ESPP this lookback feature will be one of the major drivers of large returns.

Salesforce ESPP Contribution Limits

The IRS limits what you can contribute to an ESPP and that limit is $25k per year. With the 15% discount that Salesforce gives, the real limit is actually $21,250. If you want to learn more about the calculation, please read our ESPP Basics article.

Employers will also limit how much of your salary you can contribute to the ESPP. Salesforce allows its employees to contribute between 2% and 15% of their salary.

Another limit here is that the max number of shares that can be purchased is based on the value at the beginning of the offering period. For example, if Salesforce’s share price is $185 at the beginning of an offering period, then the max amount of shares you’d be able to buy during the offering period is 135 shares of Salesforce (CRM) stock. The math there is $25,000 / 185 = 135.13 shares.

Salesforce ESPP Offering Period Reset

Another big benefit to Salesforce’s ESPP is that the offering period will reset if the price at the purchase date is less than the price at the beginning of the offering period.

Let’s say the price of Salesforce is at $200 at the beginning of the offering period, but then drops to $150 at the end of the purchase period. This $150 price point will now become your new starting point and the offering period will start there and last for one year. So if/when the price climbs back up to $200, you’ll still be able to purchase at $200 a share.

Salesforce ESPP Fractional Share Purchasing

This is one area where companies are improving their ESPPs. Currently, Salesforce’s ESPP does not offer fractional share purchasing (which is kind of a bummer since Salesforce is trading at ~$225 a share).

This means that if you saved $240 to purchase shares through Salesforce’s ESPP, you’d only be able to purchase 1 share of CRM. The money that doesn’t get used will roll over to the next purchase period or be refunded to you.

A lot of companies do not offer fractional share purchasing because it’s a an administrative headache, but as company share prices increase, allowing fractional share purchasing becomes more and more attractive.

Salesforce ESPP Performance Over the Last Year, 2 Years, and 5 Years

We just provided details of Salesforce’s ESPP’s structure, so now it’s time to dive into the details illustrating just how much money you would have made by maxing out Salesforce’s ESPP.

To illustrate Salesforce’s performance, we’ll look back over the last year, 2 years, and 5 years. Since Salesforce doesn’t offer fractional share purchasing, for the purpose of this illustration, we’ve decided to round down the number of shares purchased at the end of each purchase period to the nearest whole share. So if you had enough money to purchase 70.85 shares at the end of a period, we’d assume that you’d only purchase 70 shares.

Salesforce’s ESPP 1-Year Performance - 6/16/2022 to 6/15/2023)

Here’s the high-level 2022 to 2023 performance of Salesforce’s ESPP.

Salesforce employees that began contributing to the ESPP in June of 2022 saw some of the best single year gains we’ve seen in an ESPP.

Participants were able to use their $21,250 in contributions to purchase 190 shares of Salesforce stock. The total value of those 190 shares on 6/15/2023 was worth $41,829 and of that, $20,579 would be gains.

Even if you didn’t manage to max out the ESPP, the percentage gain would still be the same. And a 96.84% gain is pretty tough to beat! If you want to take a look at the full data set, we’ve provided a screenshot of the data here.

This example alone should be enough to show just how beneficial an ESPP can be.

Salesforce’s ESPP 2-Year Performance - (6/16/2021 - 6/15/2023)

Salesforce did amazing over the last year, let’s see how it did over 2 years.

Given that Salesforce’s has had some ups and downs over the last two years, the overall percentage performance was less, but overall, total gains are higher due to the extra year of contributing.

Participants in Salesforce’s ESPP over the 2-year period purchased 315 shares of Salesforce stock and ended the year with over $26k in gains. The percentage gain on the contributions to the ESPP was 63.17%.

If you want to review the full data set here’s the full details over the last two years.

As you can see, there were a couple of time where the Offering Period was reset to the price at the end of the purchase period. This is a substantial benefit as it helps ensure you’ll have better pricing going forward.

Typically when Offering Periods reset, the price used going forward is the price used at the end of the purchase period. So in this case, ESPP participants will be able to continue using the $130.44 for another six months. This will be a massive benefit if Salesforce’s share price stays where it’s at or continues to rise.

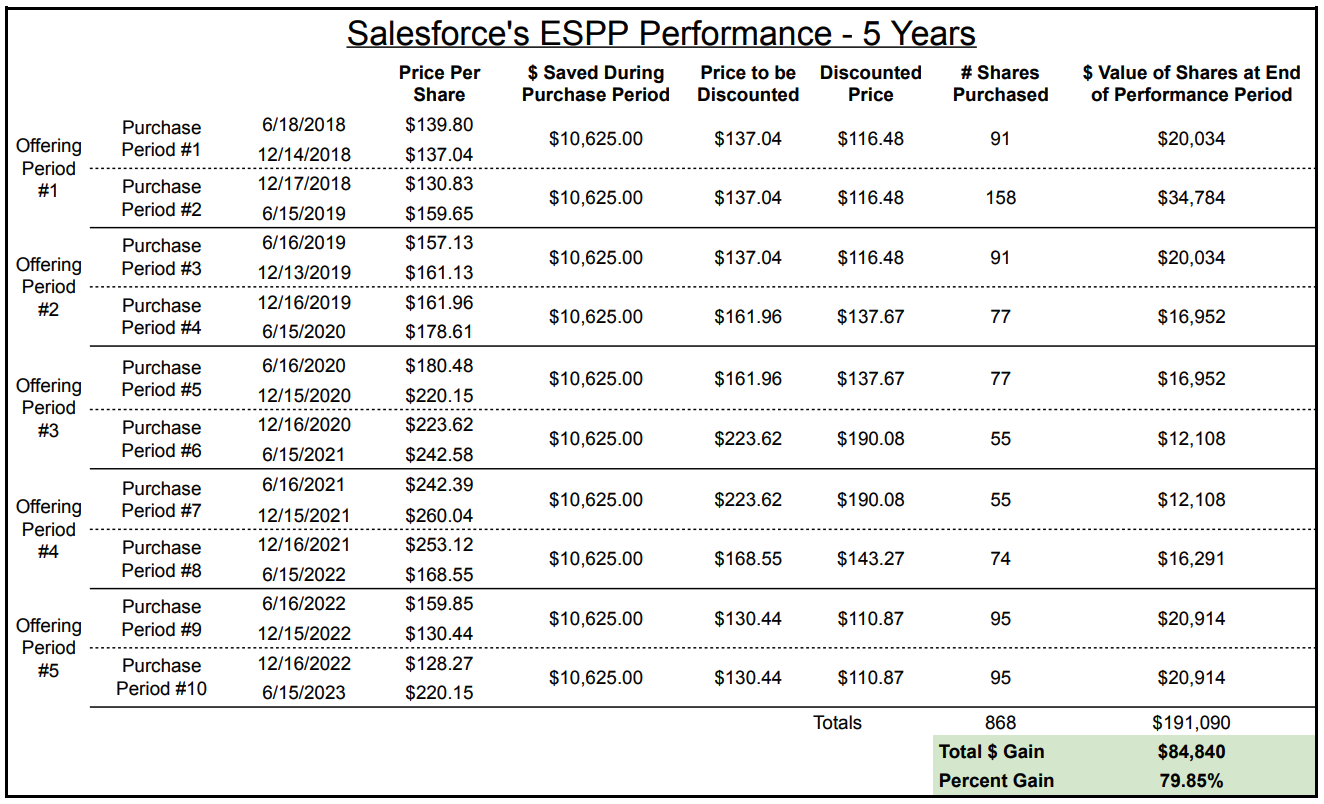

Salesforce’s ESPP 5-Year Performance - (6/18/2018 - 6/15/2023)

Now let’s look at Salesforce’s ESPP performance over 5 years:

As we expand the time period, the total gains get bigger.

Salesforce ESPP participants who contributed for the 5-year time period ended up purchasing 860 shares of Salesforce stock and finished with a gain of $84,840. The total percentage gain was a massive 79.85% gain! This type of return on investment is pretty spectacular.

Here’s the entire data set if you’d like to review the full details:

What’s interesting about Salesforce’s ESPP is that its price per share didn’t only go up during the entire 5-year period.

In many purchase periods, the share price of Salesforce dropped. This drop in share price often caused the offering period to reset.

Thanks to the ability to purchase shares at the beginning or end of a purchase period, participants were able to mostly avoid negative consequences from large drops in stock prices.

Final Thoughts on Salesforce’s ESPP

Participants in Salesforce’s ESPP over the last 5 years plus have been rewarded handsomely for their contributions.

2022 was rough and who knows what the stock is going to do in the future from 2023 on. If you work at Salesforce or are planning to work there someday, it still makes a lot of sense to max out your ESPP as soon as you’re able. Saleforce’s stock price volatility might make you decide not to hold on to stock for forever, but its ESPP is still one of the better ones out there.

This is just one example of many great ESPPs out there. If you work at another tech company that offers an ESPP, chances are that it’s worth maxing out too.

If you have any questions about the recommendations we’ve made in this article or want to ping us about something unrelated, you’re welcome to reach out to us at team@equityftw.com.