Nvidia’s ESPP is a Top Performer

Nvidia has been pushing boundaries and revolutionizing technology for the last couple of decades. Nvidia seems to prioritize putting their people first, and Nvidia’s Employee Stock Purchase Plan (ESPP) has been living proof of this priority. Most ESPPs are a great employee perk, but Nvidia’s ESPP is arguably one of the best in all of tech.

The purpose of this article is to review Nvidia’s ESPP structure, its past performance, and what you can expect from participating in it going forward.

Since this article specifically focuses on Nvidia’s ESPP, it will not cover all the beginner details of ESPPs. So if you’re looking for a quick refresher on ESPP Basics, please read our previous articles “How Much You Should Contribute to Your ESPP” and “When Should You Sell ESPP Shares.”

All that said, let’s dive into how Nvidia’s ESPP is structured so we have a better understanding of what it has to offer. (Please keep in mind Nvidia did a stock split so the stock prices are different but the percentage gains are the same.)

Nvidia’s ESPP Purchase Period

A purchase period is the time in which employees participating in an ESPP set money aside with each paycheck until the very end of the purchase period. At the very end, the money that’s been set aside is used to purchase company stock.

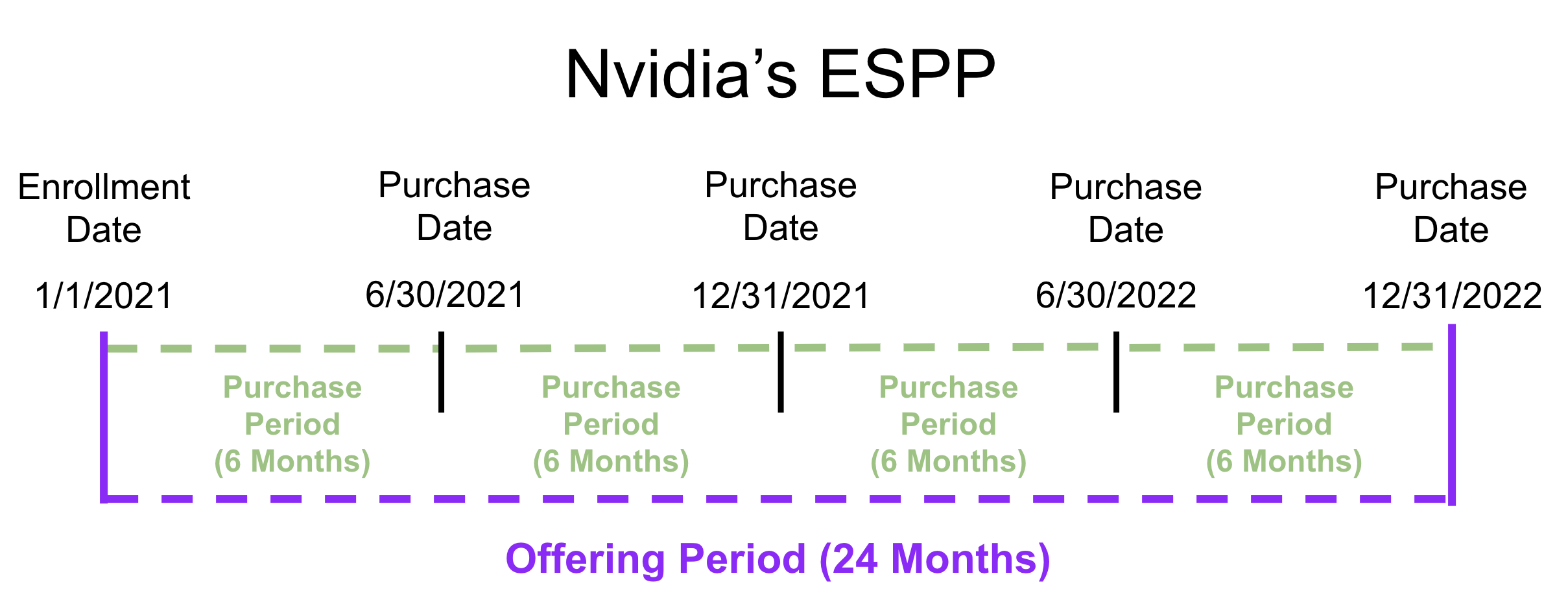

Typically most tech companies offer a purchase period of 6 months, and Nvidia’s ESPP falls right in line with that. Nvidia offers a 6 month purchase period for those contributing to their ESPP.

Nvidia’s ESPP Offering Period

An offering period is the period of time that the company will allow employees to purchase company stock. It’s usually the same length of time as the purchase periods, but it can be longer if the company is wanting to provide a bigger benefit to its employees.

Nvidia’s offering period is a full 24 months, and within those 24 months are four purchase periods.

Here’s an illustration to help show what it looks like:

There aren’t many tech companies that offer 24 month offering periods, and when they do, it usually ends up providing a massive benefits to those participating in the ESPP.

Nvidia’s ESPP Discount

The biggest reason to contribute to an ESPP is because there’s usually a discount given for employees purchasing stock. Typically discounts in ESPPs range from 5% up to 15%.

The majority of tech companies offer the maximum discount here, and Nvidia does too. Nvidia’s ESPP offers a 15% discount.

This may not seem like that big of a deal, but the reality is that you can receive a value much greater than just that 15%.

Nvidia’s ESPP Lookback

An ESPP lookback is where the company will apply the discount to either the price per share at the end of the purchase period or to the price per share at the beginning of the offering period - whichever is cheaper.

This is where the ESPP becomes really appealing. If Nvidia only goes up over 24 months, ESPP participants will be able to buy at the low point way back in month one. On top of using the price from basically two years prior, participants get a discount on top of that!

Once we get into the examples showing the actual performance of Nvidia’s ESPP, this lookback feature will be one of the major drivers of large returns.

Nvidia’s ESPP Contribution Limits

The IRS limits what you can contribute to an ESPP and that limit is $25k per year. With the 15% discount that Nvidia gives, the real limit is actually $21,250. If you want to see the calculation yourself, you’re welcome to try our ESPP Gain and Tax Calculator

Employers will also limit how much of your salary you can contribute to the ESPP. Nvidia allows its employees to contribute up to 15% of their salary.

Another limit here is the max number of shares that can be purchased is based on the value at the beginning of the offering period. For example, if Nvidia’s share price is $450 at the beginning of an offering period, then the max amount of shares you’d be able to buy during the offering period is 55 shares of Nvidia (NVDA) stock.

Nvidia’s ESPP Offering Period Reset

Another big benefit to Nvidia’s ESPP is that the offering period will reset if the price at the purchase date is less than the price at the beginning of the offering period.

This perk has proven to be really helpful in a choppy stock market.

Let’s say the price of Nvidia is at $450 at the beginning of the offering period, but then drops to $200 at the end of the purchase period. This $200 price point will now become your new starting point and the offering period will start there and last for two years. So if the price climbs back up to $450 within 24 months, you’ll still be able to purchase at $200 a share.

Nvidia’s ESPP Fractional Share Purchasing

This is one area where companies are improving their ESPPs. From what we’ve gathered, Nvidia’s ESPP does not offer fractional share purchasing (which is kind of a bummer since Nvidia is trading at ~$465 a share).

This means that if you saved $900 to purchase shares through Nvidia’s ESPP, you’d only be able to purchase 1 share of NVDA. The money that doesn’t get used will roll over to the next purchase period or be refunded.

A lot of companies do not offer fractional share purchasing because it’s a little bit of an administrative headache, but as company share prices increase, allowing fractional share purchasing becomes more and more attractive.

Nvidia’s ESPP Performance Over the Last Year, 2 Years, and 5 Years

We just provided arguments detailing why Nvidia’s ESPP is great, so now it’s time to dive into the details illustrating just how much money you would have made by maxing out Nvidia’s ESPP.

To illustrate Nvidia’s performance, we’ll look back over the last year, 2 years, and 5 years. For the purpose of this illustration, we’ve decided to round down the number of shares purchased at the end of each purchase period to the nearest whole share. So if you had enough money to purchase 70.85 shares at the end of a period, we’d assume that you’d only purchase 70 shares.

Nvidia’s ESPP 1-Year Performance (7/1/2022 to 6/30/2023)

With each of these performance periods, we’re assuming that no shares of Nvidia are sold. Here’s the high-level 2022 to 2023 performance of Nvidia’s ESPP.

Nvidia employees that began contributing to the ESPP in 2022 saw some extraodinary 1-year gains.

Participants were able to use their $21,250 in contributions to purchase 170 shares of Nvidia stock. The total value of those 170 shares on 6/30/23 was worth $72,759, and of that, $51,509.44 would be gains.

Even if you didn’t manage to max out the ESPP, the percentage gain would still be the same. And a 242.40% is insane! If you want to take a look at the full data set, we’ve provided a screenshot of the data.

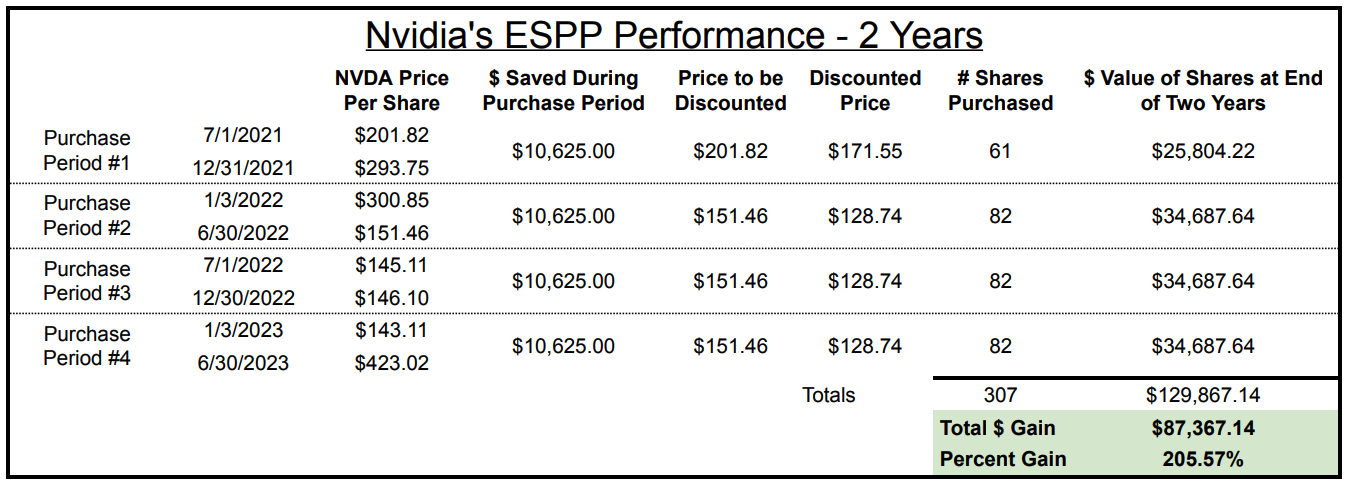

Nvidia’s ESPP 2-Year Performance (7/1/2021 - 6/30/2023)

Nvidia did about as good as any company ever over the last year. Let’s review how the last two years have been.

Even with the choppiness in Nvidia’s stock price, its ESPP has performed extraordinarily well.

Participants in Nvidia’s ESPP over the 2-year period purchased 307 shares of Nvidia stock and ended the year with over $85k in gains. The percentage gain on the contributions to the ESPP was 205.57%.

If you want to review the full data set, we’ve provided a screenshot of the full data set. We’ve also provided an image below that you can review more closely.

Now that we have a couple years’ worth of data, let’s look at one of the drivers that’s causing such great performance.

Nvidia’s Share Price Appreciation + Offering Period

In the full details above, there is one Offering Period and within that Offering Period are four purchase periods. At the end of each purchase period, rather than purchase company stock based on the value of Nvidia on that date, employees are able to take full advantage of their Lookback feature.

At the beginning of the offering period, Nvidia was trading at $201.82. The offering period lasts a full two years, but because there is a reset provision, the offering period resets on 6/30/2022 to the price at that time. So rather than maintaining the $201.82 pricing, ESPP participants reset their offering period with $151.46 as their new beginning price.

This reset enabled participants to purchase more shares than they would have been able to without it.

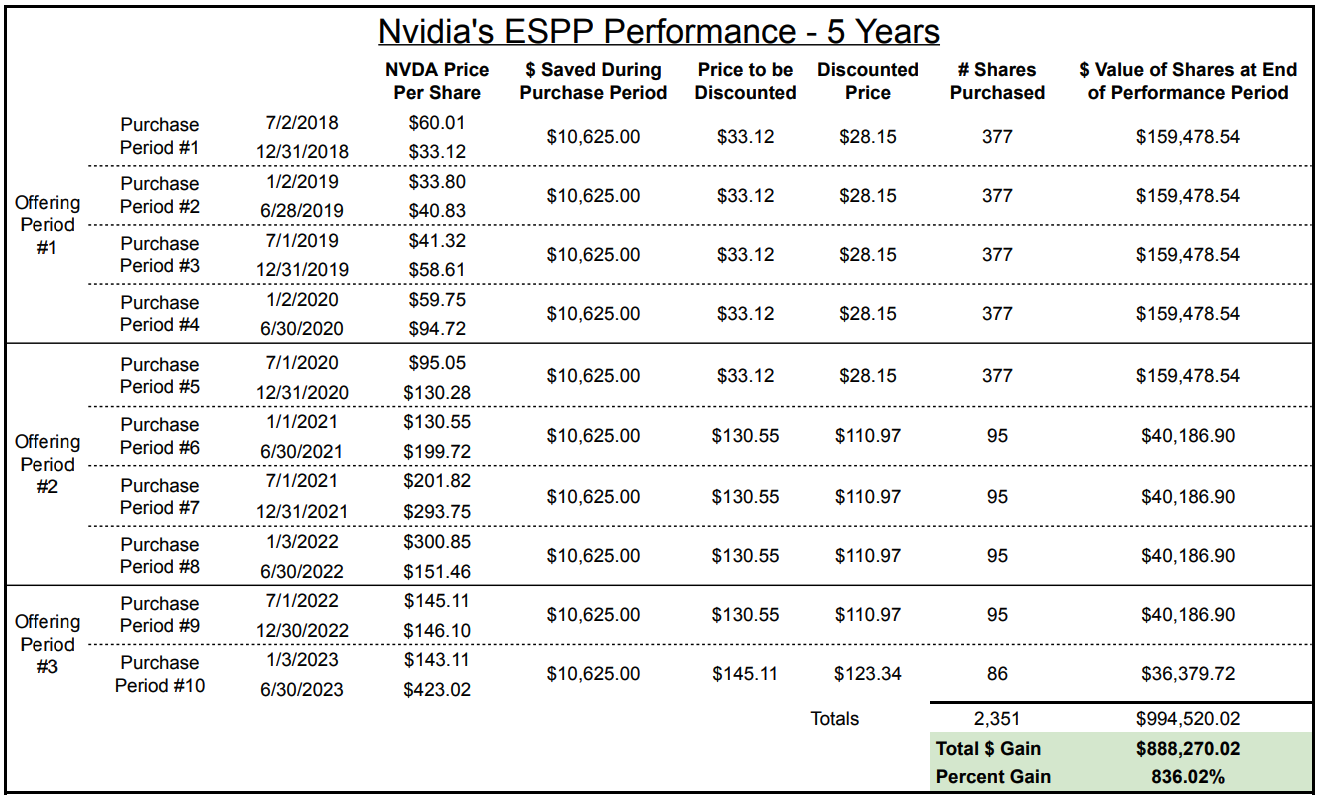

Nvidia’s ESPP 5-Year Performance (7/2/2018 - 6/30/2023)

Now let’s look at Nvidia’s ESPP performance over 5 years:

As we expand the time period, the returns get even bigger. (And they were already crazy.)

Nvidia ESPP participants who contributed for the full 5-year time period ended up purchasing 2,351 shares of Nvidia stock and finished with a gain of $888,270.02. The total percentage gain was a whopping 836.02% gain! This type of return on investment is astounding.

Here’s a link for the entire data set, and here’s an image of it:

Obviously the performance is outstanding, but what’s interesting is how quickly share price has bounced back in 2023. Which means that if Nvidia ESPP participants from before that managed to hang onto their shares, they would have been rewarded for holding on long term.

Final Thoughts on Nvidia’s ESPP

Assuming nothing was ever sold, participants in Nvidia’s ESPP over the last 5 years have basically been able to become millionaires off of just the ESPP alone. This kind of price appreciation over a 5 year period doesn’t happen often, so it’s hard to believe this same growth pattern will continue. (Though we said the same thing a couple years ago!)

It’s pretty common advice for people to say you should sell your ESPP shares immediately after purchase, but this is a prime example of a time where you wouldn’t have been better off selling everything immediately after purchase. We’ve also written an article discussing how to manage NVDA RSUs and there are some similarities between how to manage RSUs and how to properly manage ESPP shares. Nvidia now lets employees choose how they want to handle their tax withholding on NVDA RSUs.

Who knows what the stock is going to do in the future, but if you work at Nvidia or are planning to work there someday, it makes a lot of sense to max out your ESPP as soon as you’re able to.

This is just one example of many great ESPPs out there. If you work at another tech company that offers an ESPP, chances are that it’s worth maxing out.

If you have any questions about the recommendations we’ve made in this article or want to ping us about something unrelated, you’re welcome to reach out to us at team@equityftw.com.