Building a Sales Priority for Figma Equity

IPO lock-up has finally ended for people at Figma,( aka Figmates). After waiting what’s probably seemed like the longest 6 months of your life, you now have an opportunity to sell your FIG equity. You just need to build a sales priority for the FIG equity you own.

With a share price of $33 at IPO, up to $142, then back down to $44 the day after lock-up, it’s likely you’ve experienced significant whiplash. With these big price movements, you probably have some questions about building a sales priority:

How much FIG should I sell?

What types of equity should I sell first? RSUs? NSOs? ISOs?

Should I choose to sell one equity type over another? And if so, why?

What are the tax consequences if I do sell?

How do I actually press buttons and trade throughout the day?

What do I do with the money afterwards?

The purpose of this article is to answer these questions, or at the very least, help you begin to think through the best options for your specific situation.

Times like these usually warrant the hiring of a professional, so you’re welcome to check out our services and see why it might make sense to hire an advice-only advisor. We want to help you make the most of a really successful IPO!

Table of Contents ▼

Foundation for Figma Sales Priority

In order to figure out what to do with all of your Figma equity, you’ll need to get organized first. Then you’ll want to commit some time to learning how each equity type works.

Organizing Figma Equity

To start, you’ll want to gather some baseline information for each type of equity that you own. Shareworks is where all the details reside, but if you want to manipulate the data later, you may want to copy the data or import it into Google Sheets.

Figma has offered all three of the major forms of equity compensation. Restricted Stock Units (RSUs), Nonqualified Stock Options (NSOs), and Incentive Stock Options (ISOs).

Regardless of when you started at Figma, you’ll want to gather the following:

Net amount of shares you received at the tender from RSUs (if applicable)

Net amount of shares you received at the IPO from RSUs

Total number of NSOs, their expiration dates, their exercise prices, and the number of options you’ve already exercised

Total number of ISOs, their expiration dates, their exercise prices, and the number of options you’ve already exercised

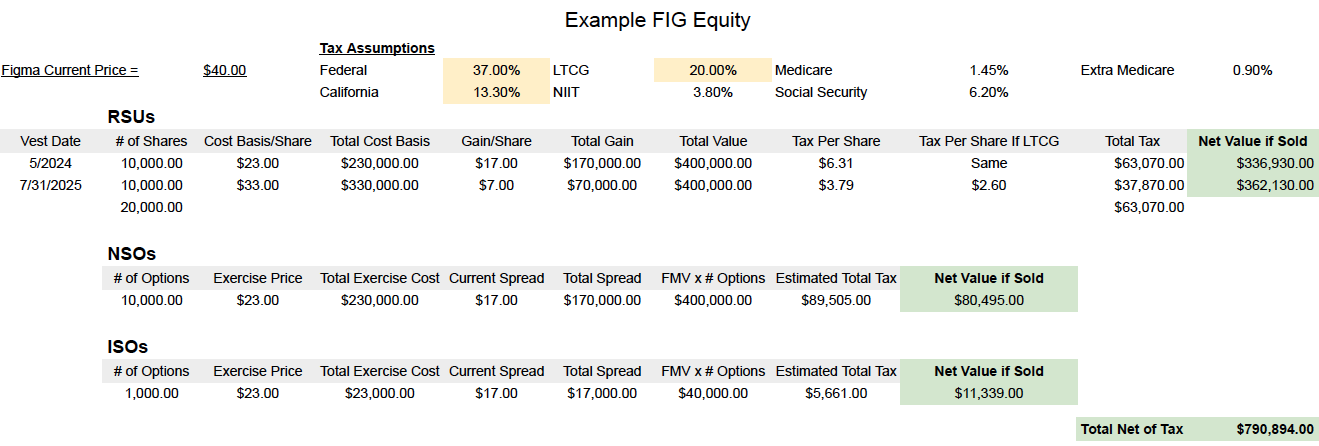

If you want to be extra thorough, you can include the specific cost basis details, the current gains of each equity type, and the total value of each equity type. We usually break things down like the following (more or less):

Two quick, important notes on Figma equity:

First, depending on when you started at Figma, your RSUs may have vested in June of 2024 during the tender offer. This kind of complicates things, but if you have shares from RSUs that vested from that event, it’s likely to have been of benefit to you. (We’ll get into why later.).

Second, if you have quit working at Figma, ISOs only stay ISOs for 90 days, then convert to NSOs, despite what Shareworks shows on the site. ISOs can convert to NSOs for a number of reasons; separating from the employer is one of those reasons.

Understand the Basics of Your Figma Equity

We’ve written detailed articles on the basics of RSUs, tax scenarios with NSOs, and the basics of ISOs. We encourage you to spend some time reading our articles (or reading articles on other sites), but we’ve provided some beginner basics below for your convenience.

Figma RSU Basics

RSUs are taxable when they vest as regular, ordinary income. The same rates that your salary is taxed at are what your RSUs are taxed at.

So when Figma had its tender in 2024 and more recently the IPO, lots of employees had their RSUs vest, which meant that all of the RSUs that vested became taxable.

Once RSUs have been taxed, you’ll establish what’s known as a cost basis. Your cost basis is your point of reference when determining if you have a gain or a loss when you ultimately sell your RSUs. One thing to note here is that sometimes this cost basis doesn’t get reported on tax forms and can result in an RSU Double Tax.

If you hold shares for longer than 365 days, you’ll have what’s considered a long-term capital gain. If you hold for 365 or less, you’ll have a short-term capital gain. Long-term capital gains have lower tax rates compared to short-term capital gains, which follow ordinary income rates.

Whether you have a short-term or long-term gain, it’s very common (especially at Shareworks), for the cost basis to be misreported on the sales of stock. We’ve seen this lead to what’s referred to as an RSU Double Tax. We recommend reading up on that if you haven’t dealt with it before.

Another quirk of RSUs is that at vest, most of the time, companies will withhold at 22% up to $1M of income and then 37% afterwards. This can result in surprise tax bills since most people working regular jobs in tech are in a higher tax bracket than 22%.

Figma NSO Basics

Unlike RSUs, NSOs put the control of tax timing in your hands, but they require you to pay something in order to receive a share in return (known as the exercise price).

If the exercise price of your NSOs is less than the current value of Figma, you have what’s known as a positive spread or a bargain element.

At exercise, this spread/bargain element is treated as ordinary income and becomes fully taxable to you (just like with RSUs at vest). It’s at this moment that you establish your cost basis, and any gain or loss from that point forward will be a capital gain of some type, depending on how long you hold for.

Just as with RSUs, NSOs suffer from the potential to have a Double Tax and can also have tax withholding shortfalls because they also withhold at 22% for the first $1M then move to 37%.

Figma ISOs Basics

ISOs are probably the most complex of the equity types.

Unlike NSOs, if you have a positive spread on your ISOs when you exercise, there’s a chance you may not have to pay any tax.

Every year when you complete your taxes, there are two tax calculations that happen whether you’ve realized it or not: One for regular income tax and one for Alternative Minimum Tax (AMT). Depending on how the calculations shake out, you’re required to pay whichever is higher.

It’s on the AMT side of the equation that ISO exercise activity is accounted for. Eventually after exercising enough ISOs with a positive spread, you’ll tip the scales of the calculation to the point that you’ll trigger AMT tax vs regular income tax.

The payoff of ISO weirdness is that if you meet certain conditions, the gain on your ISOs will be considered long-term capital gains when you sell.

The two requirements are that you:

Sell a full year after exercise.

Sell two full years from the grant date.

ISOs can convert to NSOs if you leave Figma. If you leave Figma, you have only 90 days to exercise them while they’re considered ISOs. If you wait any longer than that, then your ISOs will convert to NSOs.

Considerations for Which Figma Equity to Sell First

Now that we’ve addressed some of the basics, let's examine some important considerations for building your sales priority.

Consideration #1 - How much FIG is too much for you?

Evaluating how much company stock is too much is different for every person, but it’s an important starting point when thinking through how much FIG you want to keep or sell.

It’s helpful to think through questions such as:

What percentage of my liquid net worth is tied to Figma equity?

How does selling FIG help me achieve other financial goals? Is the current price point enough to get me where I want to be?

How would I feel, and how much would it help if FIG doubled in price?

What about the opposite? How would I feel, and how badly would it set me back if FIG were to drop by 50% or 80%?

When we work with clients, we help them determine the net tax number that should be diversified for them to accomplish their financial goals. This will be different for every client we work with.

Consideration #2 - What does your income look like this year and next?

If you want to be successful at tax optimization, at the very least, you will have to have a good estimate of what your taxable income will look like this year and next.

We’re currently near the end of the year, which provides an excellent opportunity to potentially spread transactions across two tax years in pretty quick succession to help keep us within certain tax brackets.

Consideration #3 - Don’t forget NSOs are taxable at exercise.

Because the spread of NSOs is fully taxable at exercise, it often makes sense to sell immediately after exercise versus holding.

You can always shoot for long-term capital gains, but that only applies to the future appreciation after exercise.

The downside risk is that if you don’t sell immediately after exercise, should the stock price of FIG drop between exercise and when taxes are due, (1) there will likely be taxes due from the exercise, and (2) you may have to sell your holdings to come up with cash which could leave you with less money than you had before.

You don’t have control over FIG’s stock price, and you don’t want to owe taxes without an ability to pay those taxes.

Consideration #4 - NSOs and ISOs have expiration dates.

Whether you have NSOs, ISOs, or both, your options have an expiration date attached to them. Even if you want to hold the options indefinitely, you won’t be able to. You will be forced to make a decision.

It’s also important to be aware of the expiration dates because if you have a significant number of NSOs and wait until the last minute, you’ll have to put all your NSO exercises into one year. This can mean paying lots of taxes at the highest rates.

Consideration #5 - Top LTCG vs top Ordinary Income rate

The top long-term capital gains tax rate is 20% and the top ordinary income tax rate is 37%, but it’s important to be aware that there are other taxes that can apply as well.

On capital gains of any kind, there can be a net investment income tax (NIIT). And on income from NSOs, there can be payroll taxes (Medicare and Social Security).

This may not influence your decision one way or the other, but it’s certainly something to be aware of.

Consideration #6 - There is no long-term capital gain benefit in many states.

Although it depends on the state you live in, most states in the U.S. do not offer preferential tax rates for long-term capital gains. California, for example, treats all capital gains as just regular income, subject to its standard tax rates.

Given that most Figmates are California or New York residents, that’s something to be aware of.

Consideration #7 - What plans do you have for the cash?

The next important consideration is to carefully evaluate what you plan to do with the cash from your FIG sales.

Do you want to use the cash to buy a house? Reinvest the cash towards a more diversified portfolio? Pay down debt?

Obviously, the uses of cash are limitless, but the timing of your cash needs or financial goals could prompt you to sell more now vs later.

Consideration #8 - Know that you’ll never get it perfect.

It’s impossible to know exactly what will happen with FIG’s stock price in the future. While we’d all love to optimize every decision we make with our equity, there’s simply no way to do it with absolute certainty.

This doesn’t mean we shouldn’t do our decision-making best, but it does mean that we shouldn’t beat ourselves up too much in the future with should-haves and could-haves.

You’ll almost always have some regrets, so try not to beat yourself up if the decisions you make are not always perfectly optimal.

Instead, focus on the rationale behind the choices you made at the time and be satisfied with that. Consider yourself lucky that Figma IPO-ed. Most companies don’t!

Example FIG Sales Priority

Now that we’ve examined the foundational considerations, here’s an example of what a sales priority might look like:

Exercise/Sell NSOs across the remaining years before expiration and/or

Exercise/Sell NSOs across tax years with low income

Sell RSUs based on the lowest tax cost per share (could mean RSUs from IPO instead of tender offer)

Sell RSUs as they continue to vest (if employed)

Sell long-term FIG shares

Either exercise and hold ISOs up to AMT or exercise and sell to avoid the risk of a future drop. Depending on when you received ISOs, the exercise cost could still be more than you’re willing to risk.

Assuming Figma’s stock price stays the same, it’s usually beneficial to spread out income within tax brackets of multiple years, but the caveat is that Figma’s stock price would have to stay the same.

At the time of writing this article, we’re approaching the end of 2025. This means that you could potentially sell FIG equity in 2025 and then turn around and sell more at the beginning of 2026 (although this depends a bit on trading windows if you’re still an employee).

Estimating Tax on Figma Equity Sales

The only way to exactly determine the taxes from your FIG sales is to review your current paystubs, all the gains/losses you’ve had year-to-date, all the interest you’ve received, and then determine what deductions you’ll be taking this year.

If you’re just wanting some napkin-math, we often prefer to guess high, but have built the tool below to help employees guesstimate their taxes owed:

If you’re a FIG employee or ex-employee, please shoot us an email at team@equityftw.com and we’ll send you a link to copy this.

If you want to keep it ultra simple, you can just assume only Federal and State taxes are to be taken out to keep it simple.

Please be aware that if you live in California and make over $1M, you’ll want to be sure you’re taking steps to avoid underpayment penalties in California. And if you’re well over $1M, you may want to consider doing Married Filing Separately to potentially save up to $10k in CA taxes.

Pressing Buttons to Make Trades

If this is your first time really making any significant trades, you may feel a little overwhelmed by the options that Shareworks throws at you.

When you go to sell your shares, there are two primary types of trades you’d consider for your FIG sales: Market orders and sell limit orders.

Market orders are placed so that whoever wants to buy your shares will buy your shares based on the current pricing that’s available.

For a sell limit order, you choose the minimum price you’re willing to accept. Your order will only execute at that price or higher. If the market never trades at or above your limit price, your FIG shares won’t be sold.

If you have tens of millions of dollars of FIG equity, it’s potentially worth calling the trade desk at Shareworks/Morgan Stanley to help make sure your sales don’t temporarily crash the price of FIG.

If you have a couple of million in shares of FIG, it’s still usually worth spacing out your sales, whether you do limit or market orders. Trading towards the middle of the day typically means a little less volatility.

If you have $100k to $200k in shares, there’s usually enough FIG stock being traded that the number of shares you have being sold won’t drastically change how people are trading FIG.

If you’re feeling really nervous, we often recommend just testing it out with a smaller number of shares/options before you give it a full go.

Final Thoughts on Sales Priority for Figma Equity

This is one of our longer articles. That’s because there are important considerations to make when deciding exactly what to do with equity. And the more types of equity you’ve received, the more potential considerations there will be.

We hope every Figmate takes advantage of this opportunity and uses it to their best advantage. It always feels a little bad to sell company stock, but it will always feel less bad if you have a solid plan in place for why you’re selling your equity.

If you find yourself needing some additional support or want a gut check, please reach out.