Choosing a Withholding Election on Apple RSUs

Apple lets employees who receive restricted stock units (RSUs) choose to withhold at non-standard rates for both Federal and California taxes when their RSUs vest.

It’s common for people to pay tax penalties driven by underwithholding from their RSUs. It’s especially hard to avoid underpayment penalties in California if you make over $1M.

Since Apple employees have the ability to change their withholdings, this article will cover why this withholding election is important, what withholding choices you have, how to determine your selection, as well as a few other considerations for managing your Apple RSUs.

Table of Contents ▼

Why Your RSU Withholding Election is Important

Choosing the right withholding election helps you avoid tax penalties and also helps ensure that you’re not caught off guard by a large tax bill come tax time.

Companies are required to withhold some level of taxes when employees’ RSUs vest.

For Federal income taxes, companies typically withhold from RSUs at 22% until $1M of RSU income, then 37% from that point forward.

For California income taxes, the standard statutory rate for RSUs is a flat 10.23%.

Apple, through its stock plan administrator (Etrade), gives employees the ability to choose the rate they’d like to withhold at for both the Federal and California levels.

So if you’re an employee at Apple, there’s a very good chance that you should go in and adjust your withholdings upward, since there’s a very high likelihood that not enough taxes are being withheld when your RSUs vest.

Example of Tax Withholding Pain Points

Let's say you had a taxable income of $2M between your salary and RSU income.

Throughout the year, you had the following withheld from your salary, bonuses, and RSUs:

$550k for Federal income taxes

$200k for California income taxes

It’s now April, and your CPA tells you that you owe an additional:

$150k for Federal income taxes

$40k for California income taxes

If you’re like most people and don’t enjoy paying taxes, a surprise $200k of additional tax makes for a not-so-fun surprise.

And what makes it even worse is that at this level of income, there are probably penalties being assessed on the California taxes owed because not enough was withheld throughout the year.

Even if you’re not at this level of income, being surprised by any additional taxes or penalties is a major annoyance and is pretty likely given how RSUs work.

Withholding Choices for RSUs at Apple

To make changes to your withholding election, you’ll want to log in to Etrade and look for the option to change your “Tax Election”.

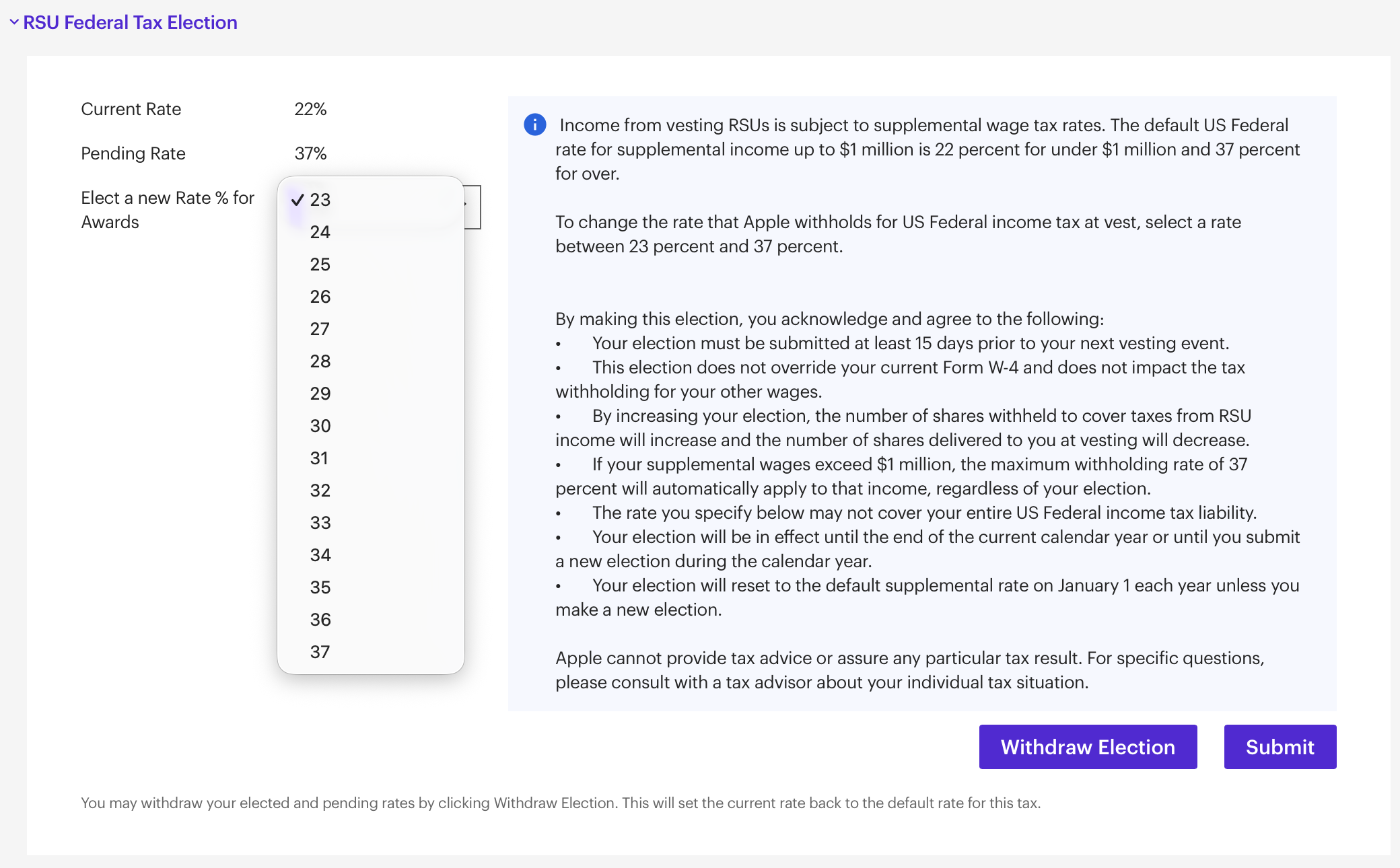

For Federal taxes, Apple lets you choose any percentage increment you want between 22% and 37%.

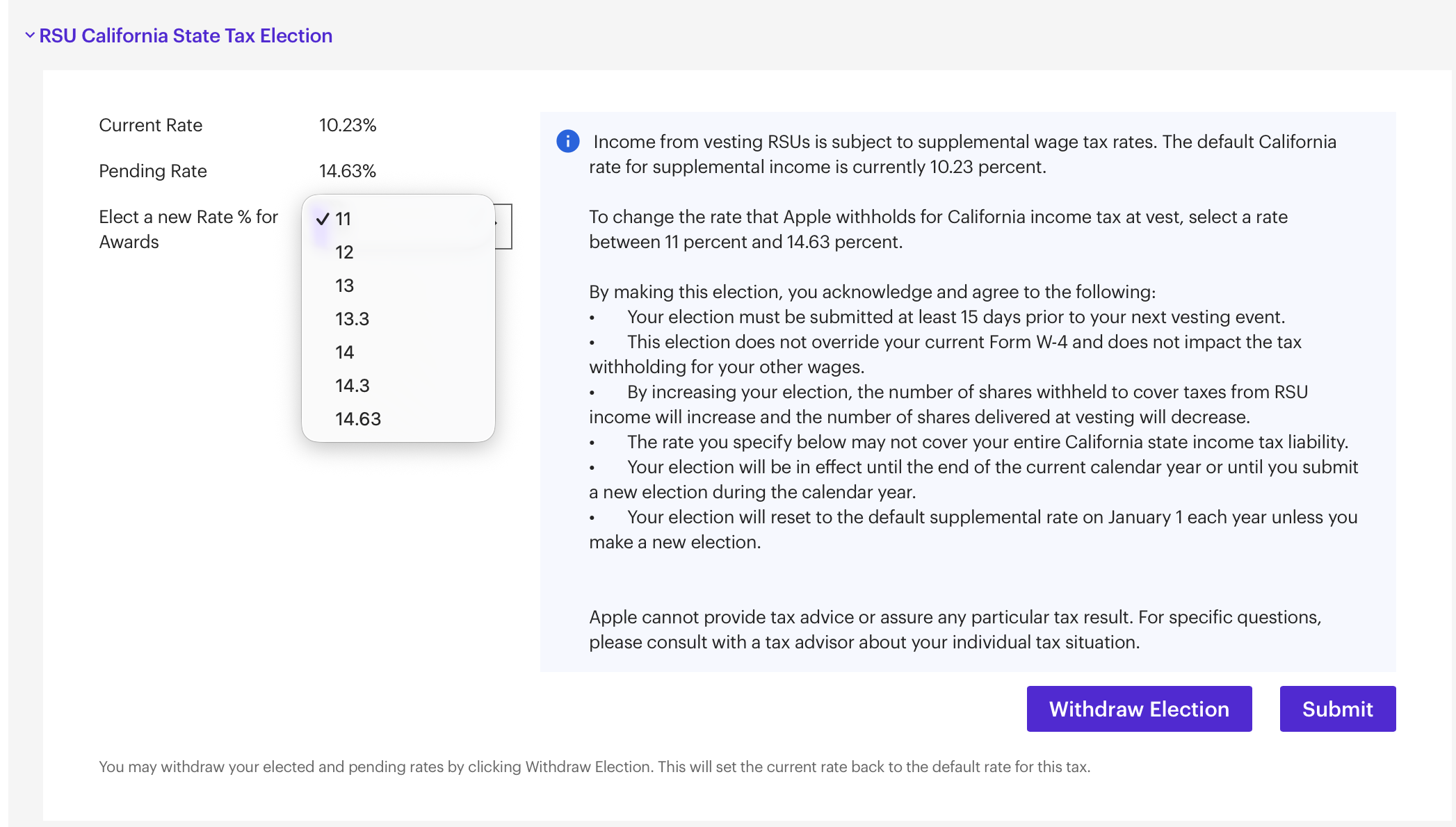

For California taxes, Apple lets employees choose to withhold at the following rates:

10.23% (standard rate)

11%

12%

13%

13.3%

14.3%

14.63%

It may not seem like much, but the ability to choose your exact withholding rate at both the Federal and California levels is a big deal.

Here are some screenshots of what the menu actually looks like at Etrade:

Determining a Withholding Choice for Apple RSUs

Since you have the ability to change rates for both Federal and California taxes, you’ll want to spend a little bit of time understanding the potential impacts of your choices for both.

Step 1 – Familiarize Yourself with Federal and California Income Tax Brackets

The first thing you’ll want to do is get familiar with income tax brackets so you have a rough idea of what tax brackets you’ll be taxed at.

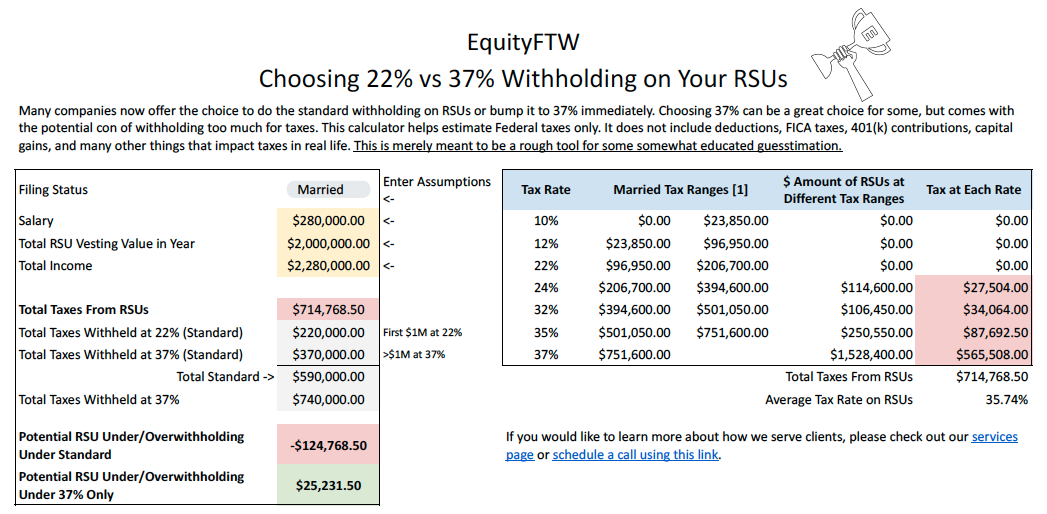

To help you assess where you fall within the Federal tax brackets and to help you determine whether you want to do 22% or any percentage up to 37%, we’ve built the withholding calculator below. If you’re an Apple employee, we’ll grant you access to a version of your own. Just send us a note at team@equityftw.com.

As you can see, it only has a comparison of 22% vs 37% withholding, but the average tax rate on the right-hand side is still very helpful.

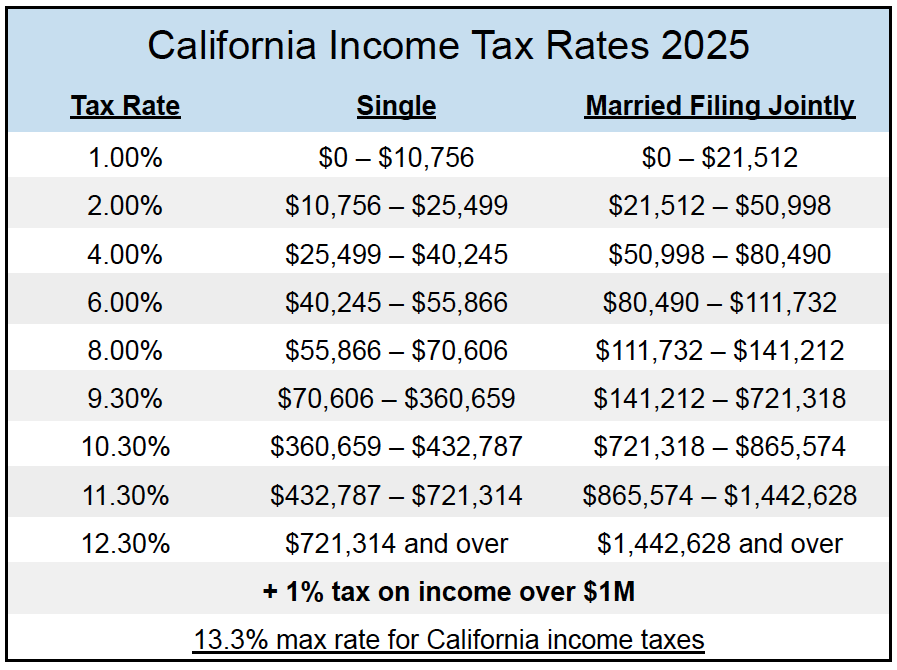

To better familiarize yourself with California income tax rates, here they are for 2025:

By looking at this chart of income tax rates, you can identify roughly where you might fall.

It’s important to mention that California’s tax system is progressive (just like Federal taxes). This means that as you make more money, each new dollar of income either inches towards a higher tax rate, or is taxed at a higher tax rate (until you eventually reach the highest rate).

It’s also important to mention that California doesn’t have any special income tax rates for capital gains or interest. Income is income.

Step 2 – Think About Potential Tradeoffs

When selecting your withholding percentage, it’s important that you take time to think about the pros and cons of your decision.

Pro #1 - The biggest pro of selecting a higher withholding percentage on your Apple RSUs is that it can remove all worries about taxes as it relates to your RSUs. If you select 37% or 14.63%, you can safely assume that your RSUs won’t be the cause of additional taxes owed. (Though there are plenty of other things that cause tax!)

Pro #2 - Slightly different than #1, but along the same lines, is that selecting a higher withholding rate will reduce the likelihood of being underwithheld and incurring penalties. Your withholding rate on Apple RSUs alone doesn’t avoid underwithholding or penalties, but it means that it’s one less thing that can cause underwithholding and penalties to happen.

Pro #3 - Withholding at a higher rate essentially forces you to sell Apple stock. It’s always a chore to log in to Etrade and sell shares, so by withholding a higher amount, it helps reduce some of the “action friction” by doing it for you. (A pro within this pro is that it basically allows you to trade outside of trading windows.)

Con #1 - The biggest con of withholding at a higher percentage is that it’s essentially a forced sale of Apple stock (as mentioned above).

Apple was the first $1 trillion company and is arguably the world’s strongest company. If you withhold at higher rates, you’ll probably have a smaller tax headache, but you may also miss out on some pretty substantial gains in your stock.

A perk of receiving RSUs is that while you’re waiting on your unvested RSUs to vest, you still get to benefit from Apple’s appreciation in stock price. (The reverse is also true of course.)

It’s painful to give up Apple stock, but if it helps ensure that your tax payments will be covered, maybe that eases the pain. At least slightly.

Con #2 - By withholding at a higher rate, it can mean that you receive refunds every year from the IRS and/or relevant state tax authority. Any time you receive a refund, it means there was cash you could have been using yourself, but instead it was being held by a tax authority.

If you’re someone who stresses about taxes being owed, this is probably a con you can live with.

Step #3 – Review Your Tax Details

If you know exactly what bracket you’re going to be in in a given tax year, then it’s easier to figure out what tax rate to withhold at. The problem with RSUs (especially Apple RSUs) is that your income could be vastly different over the course of a few months due to stock appreciation (or stock depreciation).

Given that most Apple employees are now on semi-annual vesting with their RSUs, it makes the tax calculations a little less frequent and painstaking to run. Running current-year tax projections throughout the year is the best way to keep awareness, and it doesn’t have to be a perfect projection.

We like to look at both the prior year’s tax return as well as annualize the current year’s data so we get a sense of how we’re tracking for taxes. Our article on how to avoid California underpayment penalties describes this process in detail.

What Withholding Choice Should You Make on Your Apple RSUs?

Since so many of you are in the highest tax brackets or are approaching the highest tax brackets, it often makes sense to select the 35% or higher options for Federal and the 13.3% or higher options for California.

If you haven’t had to deal with tax annoyances before, it might seem crazy to voluntarily choose a higher withholding percentage, but the reality is that it will save you the stress of worrying about how much you’re going to owe at tax time.

Other Considerations for Your Apple RSUs

We’ve previously written about how to manage RSUs and have also written about Apple’s ESPP. Since we’ve been discussing Apple RSUs in this article, we thought we’d also include a few quick tips for making the most of them.

Tip #1 - Make a Long-Term Plan

Nearly every Apple client we have recognizes that Apple is a good place to work, but many didn’t realize just how life-changing the experience would become.

We encourage you to take some time to really think about what’s important to you and what you’d like to accomplish with the wealth you’ve accumulated thanks to your time at Apple.

And once you’ve given it some thought, make a plan to make those important things happen.

Tip #2 - Don’t Be Afraid to Pay Taxes

Salespeople know to target Apple employees with tenure and have all sorts of products that seem like they can offer massive tax savings. Some tax-saving strategies are, in fact, fine. Some are probably fine. Some aren’t worth the hassle. And some are outright dangerous.

We have spent a ridiculous amount of time reading and researching short-term rental opportunities for clients, and the benefits are so overstated by social media that it makes us sick sometimes.

If you haven’t ever diversified anything from your Apple holdings, it’s often best just to pay your taxes and get your financial foundation set.

Just because selling stock, paying taxes, and then reinvesting is boring doesn’t mean it’s not a powerful strategy!

Tip #3 - Selling Always Feels Bad

No employee wants to part ways with their Apple stock. We get it.

If we knew the future, we could tell you exactly what would happen with Apple and exactly when you should sell.

The problem is that we don’t know. And there is no way of knowing for sure.

What we do know is that investing in 3000+ companies results in less company-specific risk and has been a proven strategy over the last 100+ years.

Getting comfortable selling Apple shares takes practice. As you get used to selling RSUs after vest, it becomes easier and easier.

Tip #4 - Selling Means Potential for Double Tax

Whenever you sell Apple RSUs or ESPP shares, there’s a chance you accidentally overpay on taxes due to what’s known as an RSU Double Tax.

When RSUs vest or ESPP shares are purchased, the vest/purchase establishes your cost basis in your Apple position.

Someday when you sell those shares, Etrade will often report your cost basis on tax forms incorrectly. To fix it, they’ll generate a Supplemental 1099 or a Transaction Supplement (referred to by many names). None of this necessarily has to do with how RSUs are taxed, but it has more to do with the fact that cost basis tracking is messy.

Final Thoughts on Your Withholding Election on Apple RSUs

We probably made it clear throughout this article, but we like the idea of withholding at slightly higher rates simply because it reduces tax stress and removes the step of you logging into Etrade to sell Apple shares.

Whatever withholding choice you make, it should be made only after careful consideration and in coordination with a broader financial plan.

If you’re interested in working with us, we encourage you to check out our services page and book an intro call.

EquityFTW is unique in the sense that we work for a flat fee, versus requiring management of assets. We do this because we believe it reduces any potential conflicts of interest. Our goal is simply to help you make the most of your equity. That’s it.

As always, thanks for reading!