What are Double-Trigger RSUs?

Double-trigger Restricted Stock Units (RSUs) are a common form of equity compensation offered by private companies that are a little beyond the small start-up phase. In fact, if your company is planning an IPO within the next couple years, there’s a very good chance your company has started granting double-trigger RSUs.

With double-trigger RSUs becoming so prevalent, we’re frequently asked how they’re different from plain RSUs and what the “double-trigger” even means.

Double-trigger RSUs may seem similar to standard RSUs, but there are many ways they’re different. These differences impact how you should negotiate for them, how you should view their value, and how you should plan for the future.

What is a Grant of Double-Trigger RSUs?

In simple terms, a grant of double-trigger RSUs is a promise from your employer to give you company shares conditioned upon you and the company meeting certain requirements or goals.

Every instance in which your employer gives you double-trigger RSUs is called a grant. Just as with standard RSUs, companies can grant double-trigger RSUs when you first begin working, when you receive a promotion, or when you accomplish some major goal. Depending on the company, double-trigger RSUs can even be granted on a recurring basis as part of your compensation.

Usually, companies granting these double-trigger RSUs are private companies. This means that the company isn’t traded on the stock market… at least not yet.

If you’ve been working for a private company for a few years, it’s possible for you to have received multiple grants of double-trigger RSUs.

What Does the Double-Trigger Mean?

All the “double-trigger” means is that there are two requirements that need to be met before your RSUs turn into company shares and officially become yours.

By far the two most common requirements/triggers for double-trigger RSUs are:

Stay employed by the company for “X” number of years

Stay with the company until the company goes public or is acquired by another company

The first requirement is often referred to as a “vesting schedule.” For private companies, it’s common to see vesting occur annually over 4 years. For example, if you were granted 1,000 double-trigger RSUs, this would mean that 250 would vest each year.

The second requirement is often referred to as the “liquidity event requirement.” The most common way for this requirement to be met is for your company to IPO/go public or to be purchased by another company.

When Do Double-Trigger RSUs Become Yours?

Double-trigger RSUs officially become yours once you meet both of the requirements stated in your grant documents/grant agreement.

This is the “catch” with double-trigger RSUs: If you’ve received thousands of double-trigger RSUs, not only do you need to work long enough at the company to check off the “time worked at company” box, but you will also need to hope that the company goes public or is acquired.

This is a particularly tricky requirement because depending on your position at the company, you may have little impact on whether the company goes public or is suitable to be acquired.

And complicating things further, sometimes market conditions just stink. 2022 was an extremely dry year in terms of companies going public or being acquired, so we saw thousands of people’s plans to cash out their double-trigger RSUs put on hold.

How Are Double-Trigger RSUs Valued?

Double-trigger RSUs of private companies are valued based on the company’s value per share. To determine this value per share, companies will perform what’s called a 409a valuation and the value per double-trigger RSU will rise and fall based on that valuation.

Typically private companies will have this type of valuation done at least annually, but if a liquidity event is approaching, companies will do them more frequently. If you’re working for a brand new start-up, then it can be a little more variable and 409a valuations may not be done on a regular basis.

Of course, if the company never has any kind of liquidity event, then any value is just paper value.

Once a company goes public, the value of any type of RSU is based on what the company is currently trading for.

When Do You Owe Taxes on Double-Trigger RSUs?

The fancy way of saying when double-trigger RSUs become taxable is to say they become taxable “when there is no longer a substantial risk of forfeiture.”

This basically just means that your double-trigger RSUs become taxable once they actually become yours.

With single-trigger RSUs, you usually owe taxes as the RSUs vest (since that’s the only requirement). In this case, you would simply take the total number of RSUs that are vesting multiplied by the market value on that date, and voila, that would be the amount that’s taxable to you.

Here’s an example of what 1,000 single-trigger RSUs would look like over 4 years:

As you can see in this example, in the case of single-trigger RSUs, 250 shares vest and become yours (and therefore taxable) every year. At the time of vesting, it’s easy to calculate the total taxes you will owe which makes them easy to plan for. (We’ve created a free RSU tax calculator for you to use if you’d like to check it out.)

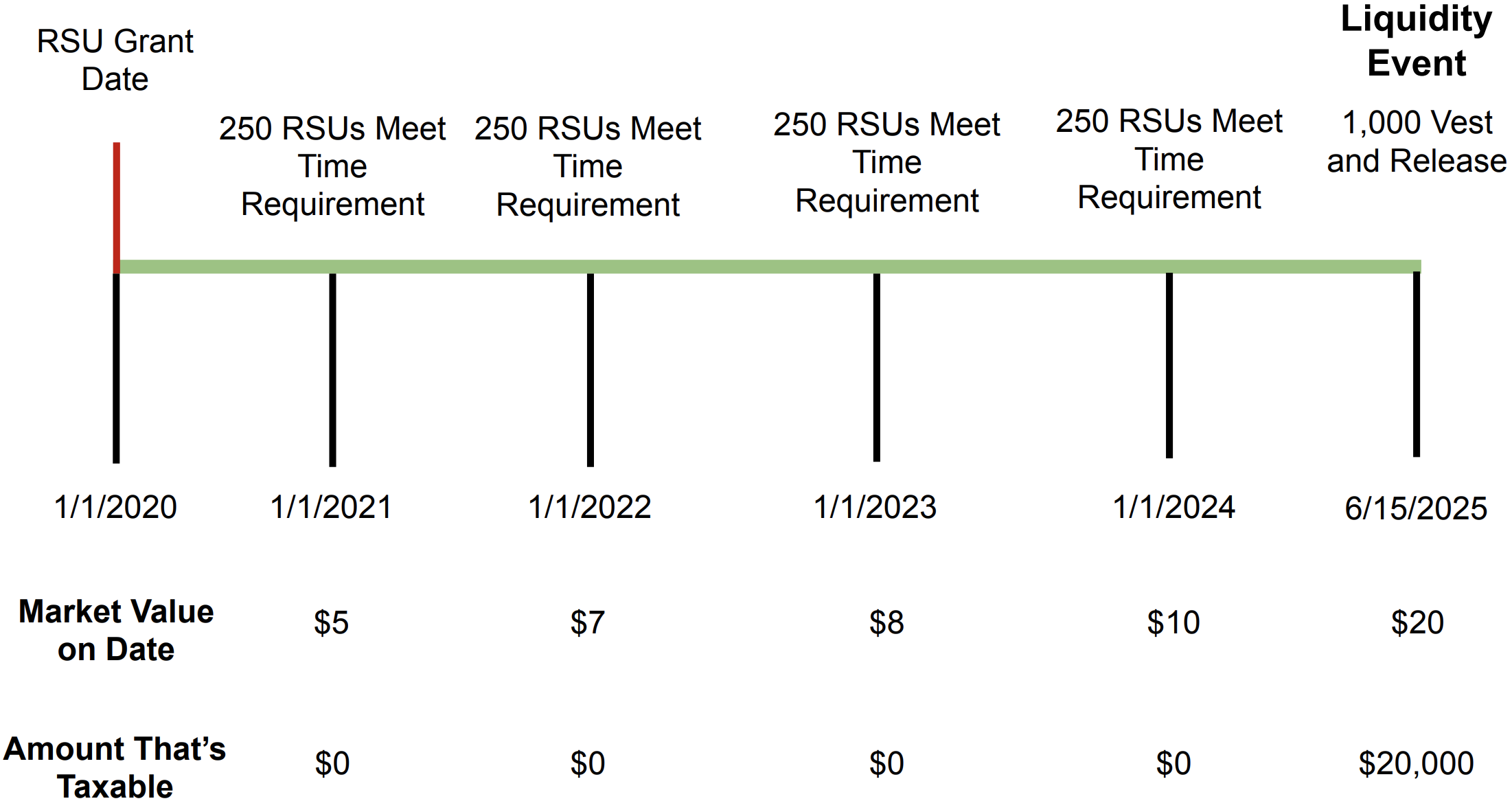

Now let’s take a look at double-trigger RSUs. Pay close attention to when the 1,000 shares of double-trigger RSUs become taxable.

As you can see, the person in this example met the time-based requirement over four years and didn’t incur any taxes until the Liquidity Event in 2025. Then in 2025, when all 1,000 RSUs were released, $20,000 became taxable.

This is important because if you’ve received large grants of double-trigger RSUs, you’ll want to make a tax plan for the large income you’ll be receiving in the year of a liquidity event. And if this liquidity event involves hundreds of thousands of dollars, we’d recommend consulting with a tax professional. (We recommend reading our article on how to avoid taxes on RSUs as some of the strategies apply in this scenario as well.)

Why Do Companies Grant Double-Trigger RSUs?

There are various reasons companies like to grant double-trigger RSUs. Some are for the benefit of employees, and others are for the company’s benefit.

Employee-centric Reasons to Grant Double-Trigger RSUs:

Studies show that owning equity helps employees work harder, enjoy their job more, and feel more fairly compensated. Providing double-trigger RSUs doesn’t mean you immediately own equity in a company, but it does mean that you might be able to later down the road.

Double-trigger RSUs can provide great upside. Even if you aren’t an early employee at a company, double-trigger RSUs still provide tremendous upside if the company ends up having a successful liquidity event.

The delayed taxation of double-trigger RSUs can be easier on cash flow. With single-trigger RSUs, you’re taxed as shares vest and you meet the time requirement. If you had single-trigger RSUs at a company that was still private, figuring out the tax situation is difficult because you can’t freely sell shares on the stock market.

Company-centric Reasons to Grant Double-Trigger RSUs:

Even if an employee works at the company for several years, that company does not have to release equity to employees until a liquidity event actually happens. Especially if it takes awhile for a liquidity event to happen, many employees forfeit double-trigger RSUs because they don’t stick around long enough to get the benefit.

They are easy to administrate. Because there are no tax withholdings to consider as employees meet the time requirement, they are pretty easy to manage.

Since RSUs typically don’t carry voting rights, shareholders of the company don’t have to worry as much about new shareholders affecting company decisions because no double-trigger RSUs have turned into shares owned by other people.

Do You Want Double-Trigger RSUs?

Absolutely. And we recommend negotiating to get them if you’re in a position to do so.

Companies that offer double-trigger RSUs are usually companies that are growing rapidly. If you’re only receiving cash compensation, you might miss an opportunity to benefit financially from large increases in valuations. Owning double-trigger RSUs helps ensure that you don’t miss out on a big liquidity event.

That said, you should view double-trigger RSUs a little more like a lottery ticket than standard RSUs. Because the company may never actually have a liquidity event, you don’t want to bank on the value of the double-trigger RSUs until a liquidity event becomes certain.

Double-Trigger RSUs Final Thoughts

Double-trigger RSUs are a great form of equity compensation, but there are a few strategies we’d recommend you consider to manage them properly.

When evaluating a company’s offer letter, make sure you ask about the vesting conditions of the RSUs. You’ll want to know whether the RSUs being offered are single-trigger or double-trigger.

Use the vesting uncertainty of double-trigger RSUs to your advantage. Employers know that double-trigger RSUs are harder for employees to value. You can use this to (1) ask for more double-trigger RSUs, (2) ask for more cash instead, and/or (3) ask for another form of equity compensation instead (like nonqualified stock options).

If/when a liquidity event happens, be sure to have a plan in place to manage the taxes. There are a few strategies you can use to avoid taxes, but some require planning ahead of time.

We’ll publish more articles on double-trigger RSUs in the future. Because 2022 saw so few IPOs, many companies are issuing double-trigger RSUs right now.

If you’d like to ask us about your double-trigger RSUs, we’d be happy to provide some thoughts.

Thank you for reading. If there are any topics you’d like us to cover in future articles, please let us know.