What Makes a Good RSU Offer

There are few things as exciting as receiving a new job offer. Receiving a job offer that includes a grant of Restricted Stock Units (RSUs) adds another level of excitement, but may also come with some questions.

Whether you’re getting your first job, changing companies, or changing careers, evaluating what a company is willing to offer you in terms of both salary and equity options only heightens that thrill.

Since our expertise is focused on equity compensation, this article outlines 7 ways to evaluate whether the RSU offer you’ve received is a good one or not.

#1 - The offer aligns with what others are reporting on Blind, Glassdoor, Level.fyi, etc

The first way to determine whether the RSU offer you’ve received is a good one or not is to review the offers others have received and posted on popular salary and equity-sharing websites.

Blind, Glassdoor, Fishbowl, Levels.fyi are all great resources that empower employees to ensure they’re getting paid what they should.

With enough digging, you can usually get a pretty good range of what the RSU piece of your compensation should look like. It may not be perfect, but it’s a great place to start.

If the company is a start-up it can be a little more difficult to find this information, so look at what other similar start-ups are offering for comparable positions at their companies.

#2 - The RSU offer leaves room for negotiation

The best types of RSU offers leave room for some negotiation. Unless the offer you’ve received is perfect in every way and more than you could ever have hoped for, there’s usually some room for negotiation. Feeling heard during these discussions is extremely important and can tell you a lot about the company looking to hire you.

Most companies expect people they’ve sent offers to to negotiate those offers. One of our most popular articles addresses How to Ask For RSUs. We recommend reading it if you’d like some help/guidance.

Please note that how you navigate these negotiation discussions is critical. Be sure that you are respectful and polite. We’ve seen over-eager offer recipients have their offers retracted after pushing hiring managers’ buttons too much. Hiring managers will view how you handle these discussions as an indication of how good your communication/interpersonal skills are and what kind of employee you will be. That said, they usually expect their best candidates to negotiate a little.

#3 - The value of equity incentivizes you to bring your A-game

A good RSU offer is one that should incentivize you to put your best foot forward. One of the primary purposes of offering employees company equity is to encourage them to feel as though they have a stake in the company. Employers trust that a heightened sense of ownership will motivate employees to help the company become more successful.

Whether you feel your individual contribution to your company’s share price is minuscule or massive, a good RSU offer should provide you enough value in company shares to incentivize your efforts to improve that company.

#4 - The vesting schedule aligns with your timeline (this includes double trigger RSUs)

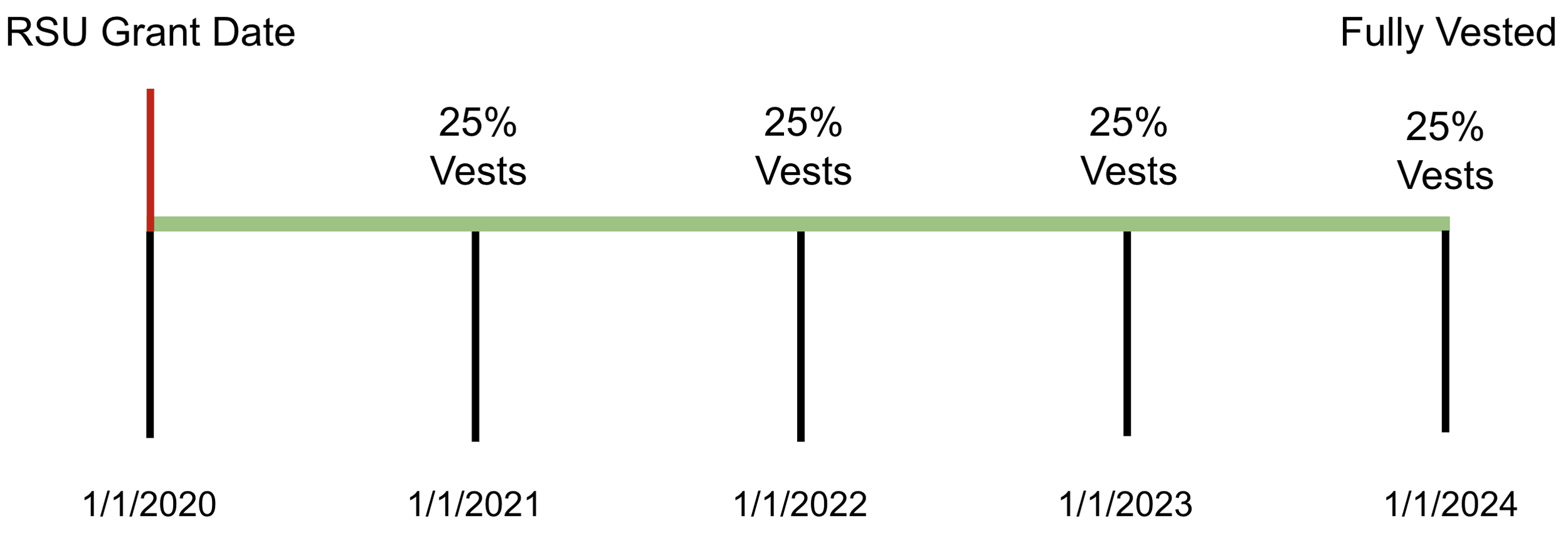

When evaluating your RSU offer, you’ll want to make sure that you understand the vesting conditions. Since RSUs don’t officially become yours until they vest, you’ll want to know exactly how long you need to wait until the RSUs become shares that you own outright.

The most common length of time it takes for RSUs to vest is 4 years, with 25% of the grant vesting each year. Here’s a sample vesting schedule below:

Although the vesting schedule shown in the image above is the most common schedule, it is certainly not the only one. There are a lot of possibilities when it comes to vesting schedules. We’ve seen the following vesting schedules:

Vesting starts immediately, vests monthly for 3 years

Vesting occurs over 4 years, 25% after year one, then a portion monthly after that

Vesting occurs over 4 years, 50% after year two, then a portion every 6 months after that (this is a common Amazon vesting schedule)

Vesting occurs over 5 years, 20% per year

Vesting occurs over 8 years, spread equally per month

Vesting occurs over 4 years, 25% per year, but also requires an IPO or acquisition

As you can see, there are lots of vesting schedules. The timing of your company’s RSU vests may become an important consideration if you’re only planning to stick around at that company for a year or two. If that’s your plan, depending on the vesting schedule, it’s possible that you may not receive the full value of your RSU grant.

We’d like to call your attention to the last vesting schedule bullet point as well. This type of vesting schedule applies to what are commonly referred to as “Double-Trigger RSUs.” These are just like regular RSUs, but rather than just a time component to their vesting, they require that the company goes public or is acquired by some other company. These types of RSUs are typically offered by companies which expect to IPO in the relatively near future, but since you can’t be 100% sure when a company’s IPO will happen, it’s something to be aware of when reviewing your offer.

It’s possible to negotiate better terms on an RSU grant; in fact, we encourage it! Just remember that those negotiations are often more nuanced than simply asking for more RSUs.

#5 - The offer takes into consideration your equity stake.

A good RSU offer will consider the equity your current employer has granted you. If you’re going to be leaving thousands of dollars on the table to switch companies, the expectation is that the new company is going to more than make up for that loss when you make that switch - or at the very least, match it.

If your current equity compensation hasn’t been a factor in the RSU component of the offer you’re considering, you may want to make it a factor.

Typically during the interview process a company will try to bait you into answering the question, “How much would you like to make?” or “What are you currently making?” Typically it’s best to avoid these questions and just say that you’re getting paid (or expect to get paid) the current going rate for your role given your experience, credentials, etc.

Sometimes it’s even helpful to put the equity you receive in terms of a percentage of your salary. For example, you could say, “I receive annual refresher grants of RSUs equal to 50% of my base salary. I hope that [new company] will be able to offer something similar.”

If you’ve discussed all of that and your RSU offer remains underwhelming, it’s usually worth bringing up your past equity compensation so that they have the opportunity to adjust it to be more in line with what you deserve.

#6 - The offer accounts for potential for future equity at the company

A good RSU offer will take into account your opportunity to receive future equity at the company. Many companies give grants of RSUs annually to employees and others do not. Many companies offer employee stock purchase plans (ESPPs) and some do not. Some companies let you receive a portion of NSOs in place of RSUs, while most don’t.

Adobe commonly gives grants of RSUs to new hires, but doesn’t provide refreshers at the same level as Google, for example. We’re not sure of Adobe’s rationale for that, but Adobe does have a killer ESPP, so maybe that’s part of their reasoning. Google, on the other hand, doesn’t offer an ESPP, but does commonly offer refresher grants of RSUs. NVIDIA offers both an ESPP and commonly grants refreshers of RSUs.

Regardless of the company, you’ll want to understand ahead of time what chances you’ll get in the future to acquire more company equity. If you won't have many opportunities to do this, ideally you’ll receive a larger one-time grant as part of your initial offer.

#7 - The company is stable and/or has room for upside

Lastly, a good RSU offer will provide you shares of a company that either already have value, or will have a lot of value in the future.

Receiving Apple, Amazon, or Google RSUs is pretty darn similar to receiving cash. These companies are significantly more stable than other newer companies. If you’re at a company that is soon going public, you could find yourself with a great opportunity to see the value of your RSUs go up before they even vest.

The good news about RSUs is that even if a company’s stock price goes down, you’ll usually still have some value to extract. That said, the best RSUs are RSUs of companies you’re expecting to appreciate in value.

Conclusion of What Makes a Good RSU Offer

As we’re writing this article, the stock price of most companies’ stock is at a low for the year and some companies are at their 3-5 year low. This may seem like a bad time to want equity, but it could also provide an opportunity. If you’re granted a respectable batch of RSUs, there’s a chance that in the next 3-4 years some of your RSUs will be worth a lot more than they were at the time of that grant.

We hold the opinion that employees and companies do better when companies offer incentivizing grants of RSUs to their employees and provide ways for their employees to acquire company equity.

We’ve discussed several important factors to keep in mind as you evaluate what makes for a good RSU offer, but if you have further questions/concerns about an RSU offer specific to you, we’re happy to share our thoughts if you reach out to us.

Thanks for reading.